A Beginner's Guide to Solidly: Strategies to Gain Exposure to Crypto's Hottest Asset

Simple strategies that you could employ to invest in Solidly and related assets

Introduction

Unless you’ve been living under a rock, you’ve probably heard of Solidly Exchange by now. Since its launch last week, it has been the hottest topic in crypto. Billions of dollars have flooded into Solidly with everyone trying to get slice of those juicy emissions. In today’s post, we will be going over simple strategies that we believe anybody can employ in order to get exposure to Solidly and related protocols/assets! If you actually have not heard of Solidly or need a quick refresher, we recommend checking out this post we made about Solidly a couple weeks ago!

Also, this post is created with the intention of helping newer and inexperienced crypto investors. We will be trying to explain these concepts and strategies in a simple manner that everyone could understand. So, if you’re a DeFi degen, you probably have been aware of or even employing these strategies already. Nevertheless, it still may be useful to you regardless of your DeFi experience!

Welcome to the Average Joe’s Crypto and we hope you enjoy this post! If you do, please help us out and give it a share! It is greatly appreciated!

We have more posts about Solidly and other interesting articles related to crypto planned for the future. If you don’t want to miss out on any of that content, make sure to subscribe!

Let’s get right into it!

Low risk? Yes, Please!

Perhaps you’re not exactly sold on this whole Solidly project. It may be too far off on the risk spectrum for you, and you don’t feel comfortable making a sizeable investment into the token of a week-old project. With today’s uncertain macro conditions, it is hard to blame you. However, there is still a way to gain exposure while adding on little to no risk.

That’s right, we’re talking about stablecoins! Currently, there are two major stablecoin liquidity pools on Solidly, the USDC/MIM pool and the USDC/FRAX pool. If you provide liquidity to these pools with your USDC, MIM, or FRAX, you can currently expect to yield good APRs through the use of another protocol called Solidex Finance. If you’re familiar with the relationship between Curve Finance and Convex Finance, Solidex is to Solidly as Convex is to Curve. Put shortly, Solidex enables users to optimize their yield, voting power, and liquidity provisioning on Solidly.

Take your USDC/MIM or USDC/FRAX LP tokens, deposit them on Solidex, and begin earning rewards! Your rewards will be in the form of SOLID (The token of Solidly) and SEX (The token of Solidex). As of writing, the APR for this strategy is 12.2% for the USDC/MIM pool and 1.9% for the USDC/FRAX pool. Through this strategy, you can build up both a position in SEX and SOLID without outright purchasing anything. OR, if you want to further increase your position in the stablecoin liquidity pools and your yield, you can take your SOLID and SEX rewards, sell them for USDC, MIM, or FRAX, and put those stablecoins back into the liquidity pools. The choice is yours!

However, these high yields will not last forever. While Solidly and Solidex are currently both currently emitting tokens at a high rate, the rate of emissions will steadily decrease over the coming weeks. As emissions decrease, so does your yield. While it is hard to predict exactly by how much these emissions will be decreasing due to a variety of factors, here is what emissions will probably look like:

Since these emissions reduce quite substantially in a short period of time, it is imperative to act quickly if this is your desired course of action. Yields will continue to only go down from here, but if you act now, you could get plenty of time making substantial yields on your stablecoins. This strategy is best suited for those who wish to remain risk adverse.

I am but a Simple Farmer Tending to my Pools

I am sure some of you read that first strategy and thought to yourselves: Pfft, only double digits APRs? Where can I get yields in the 3-digit and maybe even 4-digit APRs? Well, luckily for you, Solidly can help you achieve that also! In addition to stablecoin pools, Solidly offers liquidity pools for both other uncorrelated and correlated assets. Uncorrelated assets are two assets that have prices independent of one another. Correlated assets, in theory, should trade similarly to one another. For example, Solidly has a wBTC/renBTC trading pair. The two are just tokenized versions of BTC on Fantom and should theoretically always trade at whatever the price of Bitcoin is.

These non-stablecoin pools offer much higher APRs than stablecoin pools, but they come at the price of higher risks. The biggest risk we must mention is Impermanent Loss. If you have never heard of impermanent loss (IL) before, we recommend checking out that link we provided. We’ll still try to explain it in a few brief sentences. When you decided to provide liquidity for a trading pair (Let’s just say FTM/USDC), your position will be 50% FTM and 50% USDC. If FTM was trading at $1, and you wanted to have a LP position of $100, you would need to deposit 50 FTM and 50 USDC. Impermanent loss simply refers to the loss that occurs when the price of the two assets in the pool changes. Impermanent loss works in both ways also. Whether or not the price increases or decreases, your position in $ terms would’ve been better off if you simply just held the two assets. However, and perhaps most importantly, your losses from impermanent loss can be counteracted by trading fees + emissions. If the APR gained, in the form of trading fees and emissions, from providing liquidity is higher than the losses suffered from impermanent loss, then the $ value of your investment increased more than it would have if you simply just held.

If you’re still uneasy about impermanent loss and would like to avoid it, do not fret! There are a variety of pools that have little IL risk and yet still yield high APRs. One such example is the previously mentioned wBTC/renBTC pool. If you were planning on holding BTC anyways, why not deposit the two tokenized versions into the aforementioned pool and begin earning an APR of 44%. This APR is attained the same way as the stablecoin pools. Take your LP tokens from Solidly, deposit them on Solidex, and begin earning rewards in the form of both SOLID + SEX. Some other pools that have little to no IL risk and offering good rates are the WFTM/beFTM pool at an APR of 1,505%, the WFTM/TOMB pool at an APR of 444%, and the SPIRIT/RAINSPIRIT pool at an APR of 1446%.

If you’re comfortable with taking on some impermanent loss in the quest for gaining as much SOLID + SEX as possible, there are plenty of viable pools to do that also. Right now, the most heavily incentivized pool is the USDC/WEVE pool which is offering 1437% APR. Other pools such as HND/FTM (APR of 865%) and WFTM/GEIST (APR of 364%) are also offering good emissions. We recommend providing liquidity for assets you already planned on holding anyways. For example, if you were bullish on both FTM and HND, impermanent loss will not bother you as much as you are comfortable owning either asset anyways.

There are plenty more pools than the ones we mentioned on Solidly. Head on over to the Liquidity section of Solidly and see what pools you like best. You can check the APRs of the pools additionally over on the Pools section of Solidex. Before moving on to the next section, here are some good things to keep in mind:

Money enters a pool = APR goes down (Smaller share of rewards)

Money leaves a pool = APR goes up (Greater share of rewards)

Price of SEX or SOLID goes up = APR goes up

Price of SEX or SOLID goes down = APR goes down

Emissions to the pools change weekly based on how the veSOLID vote. Check which pools are being incentivized in the Vote section of Solidly

APRs are quoted in annual terms. We can ensure you that you will only be earning the quoted APRs for a small period of time. Do not expect to actually get a 1,000% return over a full year.

Pay attention to how much liquidity is in a pool. If there’s only a couple thousand $, you may want to avoid it

Always double-check and make sure you are depositing into the correct pool

So, I have SOLID and SEX… Now What?

Whether your farming stables or volatile assets, you’re earning SEX and SOLID. The question that now remains is, what should you do with these assets? As previously mentioned, you can of course always sell these rewards back to whatever pool you are farming and compound your position. If you’re bearish on the long-term success of Solidly and Solidex, this is probably your best option. However, if you’re bullish on SEX and SOLID, that might not be the best course of action. Here are some options for what you can do with these tokens, starting with SOLID.

SOLID

SOLID, on its own, does not really do much for you. Sure, you could use it in pools such as SOLIDsex/SOLID or WFTM/SOLID and provide liquidity. If you want to get more out of your SOLID without having to use it as a side in a liquidity pool, you must lock it as a veNFT. Locking your SOLID as a veNFT allows you vote on which pools receive emissions, receive the fees from the pools you voted for, and ensure you share of Solidly doesn’t get diluted. The longer you lock your SOLID for, the more veNFT you receive. If you’re not familiar with any of this, please go check out our first post on Solidly as we explain it much more in depth there. Locking your SOLID is arguably a necessity if you plan to hold long term. However, there are optimized ways to do this.

Rather than lock it straight on Solidly, you can use Solidex to maximize your rewards on SOLID. In the Convert section of Solidex, you can convert your SOLID into SOLIDsex. SOLIDsex is just max vested SOLID. Additionally, this process is irreversible. Once you give Solidex you’re SOLID, you can’t get it back (The mechanics of SOLIDsex and SOLID are very similar to CVXcrv and CRV). With your SOLIDsex, however, you can stake it and:

“Earn Liquidity Provider fees: 10% of all SOLID farmed by the protocol (as vanilla SOLID)”

“Earn SEX: 3.5% of the SEX that gets minted (as vanilla SEX)”

“Earn down-vote protection fees: Price determined by SEX auction (as vanilla SEX)”

Through this method, you lose your voting rights, but gain 10% of fees from all LP positions and receive SEX emissions. Currently, this method is yielding 286% APR, but expect that to drop drastically over the coming weeks. Is this trade-off worth it? Well, based upon what you do with you SEX tokens, we think it could be.

SEX

SEX, despite it’s not name, is not just a meme token. It has real value. Continuing the comparison to Curve and Convex, the SEX token is akin to the CVX token. Solidex gives you the option of vote locking your SEX for 1-16 weeks for vlSEX. When you do this, vlSEX entitles you to:

“Vote on gauges: Decide which gauges to earn future SOLID emissions using the protocol's veSOLID”

“Earn trading fees & bribes: Earn a share of the total trading fees and bribes earned by Solidex (as a mix of tokens)”

“Earn veSOLID expansions: Earn a share of the total veSOLID earned by Solidly expansions (as SOLIDsex)”

“Earn Liquidity Provider fees: 5% of all SOLID farmed by the protocol (as SOLIDsex)”

“Earn token whitelisting fees: Price determined by SOLID auction (as SOLIDsex)”

In our opinion, vlSEX is a much better deal compared to SOLIDsex. Additionally, Solidex currently has a lot of voting power. As of writing, 10,551,532 SOLID is permanently locked into Solidex. With only 1,520,000 SEX locked, you effectively control 6.94 SOLID for each SEX you vote lock. With Solidex currently controlling 34.1% of all SOLID locked, SEX is shaping up to be a powerful token.

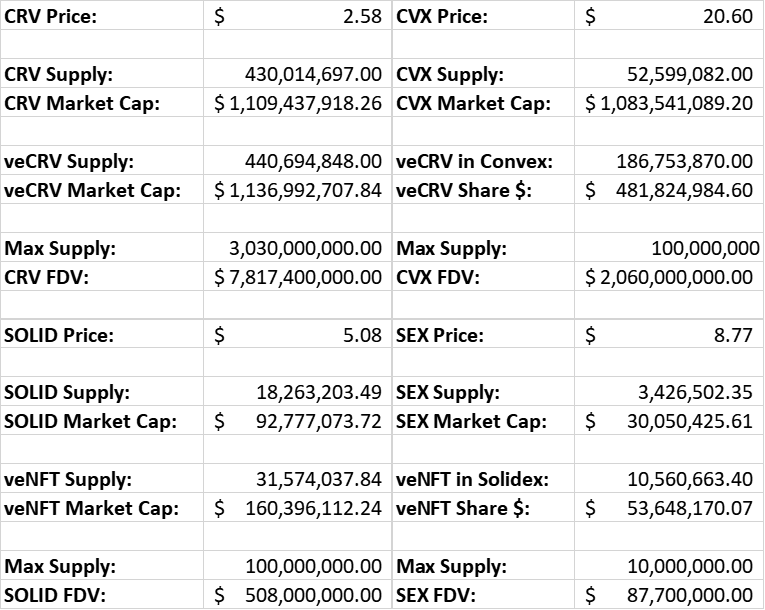

The question I’m sure you’re all wondering is which token should you prefer to own: SOLID or SEX? Building off that, is there any way to tell if one is overvalued/undervalued compared to the other. We think there could be. With these tokens only being live for a week, there is no way to truly tell if there is an appropriate way to evaluate them. But by using the comparison of CRV and CVX, perhaps we can begin to draw some conclusions. We put together a comparison of the four protocols:

By looking at it this way, two things stand out almost immediately to us:

The market caps of CRV and CVX are ~1:1 while the market caps of SOLID and SEX are ~3:1.

CVX’s market cap trades at a ~2.25 premium to the $ amount of veCRV it owns while SEX trades at a ~0.56 discount to the $ amount of veNFT it owns.

Based on this and only this, we tend to think that SEX is probably undervalued. We’ve been wrong about many things before so we wouldn’t be shocked if we were mid-curving this. Ultimately, it is up to you to decide how we should price SOLID and SEX compared to one another. For more of our thoughts on SEX and why we tend to think it is undervalued, give this Twitter thread a look.

An Opportunity Amidst the Chaos

Whenever a new protocol or project launches, not everything goes according to plan. Solidex, for example, had a bug that prevented initial launch partners from voting with their veNFTs. Thankfully, the team was able to fix it in time for the second week of emissions. However, I want to draw your attention to another “problem” Solidex has been having: Maintaining the peg between SOLIDsex and SOLID. Oh, and by “problem,” we really mean an opportunity for you. In theory, SOLIDsex and SOLID should trade roughly at a 1:1 ratio, with a slight discount for SOLIDsex. Going again to our favorite comparison of CRV and CVX, 1 CRV can typically be exchanged for ~.95 CVXcrv:

As you can tell by that chart, very rarely do you see this peg break. CVXcrv is just vested CRV, so they should be valued extremely similar to one another. Intuitavely, this should also be applicable to SOLIDsex and SOLIDsex is just vested SOLID. However, the chart for SOLIDsex/SOLID looks like this:

Maintaining the peg has been an issue, but there’s no reason to believe it will be a long-term issue. There is no reason why SOLIDsex should really ever be trading at ~0.8 SOLID. Currently, SOLIDsex is trading approximately at peg as it is worth ~.93 SOLID. However, we expect SOLIDsex to drift away from peg a few more times over the coming weeks (It’s a new project and that’s typically just how these things go). When Solidex breaks peg again, here is how you can profit:

Let’s assume you have acquired 100 SOLID. You check the SOLIDsex/SOLID pair and see that it is off peg. 1 SOLIDsex is worth .8 SOLID.

Rather than converting your SOLID to SOLIDsex through the Solidex website, you should instead purchase SOLIDsex with your SOLID through this pool. If you convert through the website, 100 SOLID gets you 100 SOLIDsex. Purchasing through this pool gets you 125 SOLIDsex for your 100 SOLID.

While you wait for the trading pair to return to peg, you can stake your SOLIDsex and earn rewards.

Once the trading pool returns to peg, probably somewhere in the range of .90-.95, you can unstake your SOLIDsex and trade it back to SOLID. If the rate was .95, then you would exchange your 125 SOLIDsex for 118.75 SOLID.

Congrats! By playing the peg, you successfully increased your SOLID position by 18.75. With your increased SOLID position, you can repeat this process the next time SOLIDsex/SOLID breaks peg or just simply sell the 18.75 SOLID for profit.

Is this strategy riskless? Of course not. You face price risk in this strategy as the $ value of SOLID could drop. This risk could be hedged however if you went short SOLID on a SOLID/stablecoin pair. Currently, however, we’re not aware of any platforms or exchanges that allow you to short SOLID. The other risk is that SOLIDsex never returns to peg. Although it is a possibility, we are not aware of any fundamental reasons why SOLIDsex could not return to peg in the long run. If you’re looking for interesting ways to increase SOLID exposure, this strategy may suit you.

Can Somebody do This Stuff for Me?

I’m sure many of you have gotten up to this point and are thinking to yourselves: Man, this is all very confusing. If you’re new to this, all the different terms being thrown at you -liquidity providing, impermanent loss, uncorrelated assets, staking, vesting, vote locking, etc. etc.- can be daunting at first. If you don’t think you’re ready to jump in and go full DeFi degen mode, do not panic just yet. There is still a way for you gain exposure to SOLID, SEX, liquidity farming rewards, bribes, trading fees, and more through owning just one asset. Allow me to introduce you to veDAO and their WEVE token.

veDAO was a DAO created back in January with one simple goal in mind: Gain as much exposure to Solidly as possible. Right out of the gate, veDAO was very successful at this as they were able to acquire the 4th largest veNFT position of 1,070,472 SOLID. Per the passing of the VIP-8 governance proposal, the goal for veDAO was to leverage their veNFT to gain even more exposure to Solidly and increase their voting power. They would do this in the form of a partnership with Solidex. In return for this partnership, veDAO would receive SOLIDsex and SEX. To generate revenue, veDAO is staking their SOLIDsex, vote locking their SEX, and farming the incentivized WEVE/USDC pair which is currently yielding at an APR of 723%. Therefore, rather than distribute their veNFT to WEVE holders, they opted to grow their treasury as aggressively as possible. Holding WEVE is essentially holding a claim on veDAO’s fast growing treasury.

veDAO has been one step ahead of everyone else and has played the launch of Solidly almost perfectly. As a testament to the flexibility of the team, veDAO was able to acquire enough SOLID to also become a launch partner of 0xDAO, another protocol that is aiming to be the Convex layer of Solidly. By our estimates, veDAO is now the 3rd largest holder of SOLID and has firmly cemented itself as a key player in the Solidly wars. It has large positions in the two competing Convex layers of Solidly. Its treasury will hold WEVE, SOLID, SEX, SOLIDsex, OXD, oxSOLID, and aim to generate revenue on those assets. Rather than try to farm and stake these assets yourself, perhaps you may want to consider leaving it up to the gigabrains over at veDAO instead.

Concluding Remarks

Well, there you have it! Some simple strategies we think anyone can employ to gain exposure to Solidly. We ourselves are utilizing all these strategies. However, if we had to pick our favorite, it would easily be owning WEVE. It is simple, yet effective at gaining exposure to everything going on with Solidly. If you couldn’t tell by now, we are pretty bullish on all things Solidly!

Before finishing up this post, we would like to quickly address a few things. By the time you’re reading this post, we’d imagine many of the APR numbers and prices are not up to date. Make sure you double-check the live numbers before you make any investment decisions. Also, we only briefly mentioned 0xDAO and OXD. This is because, as of writing this, it hasn’t been released yet. As such, we weren’t comfortable with formulating strategies for something that isn’t even out yet. Nevertheless, we are looking forward to its launch and the new strategies it will bring! Lastly, if you need technical help with things like creating LP tokens, Solidex put together a great guide that pretty much explains how to do everything. You can check it out here.

That’s all we got for this post! A lot of work, research, and effort went into the making of this. If you found it helpful and would like to donate, you can do so at our Ethereum/Fantom address:

0x7ba9aa5E4caD26EA5E8ba4AC286E5d38Af91F62b

Your support means the world to us, and we wouldn’t be able to all of this without it. Additionally, if you enjoyed this post, please help us spread the word by giving it a share. If you don’t want to miss any future content we put out, make sure to subscribe! If you have any questions, comments, or concerns, feel free to leave a comment on this post or hit us up on Twitter! Thank you once again and we hope you enjoyed!

DISCLAIMER: None of this should be treated as financial advice. It is purely for entertainment purposes only. As always, make sure to do your own research and due diligence before any investment decisions.

Great stuff, mate! I would like to know your opinion regarding playing the game raw, that is, playing alone, without Solidex, only pure Solidly.

In my first week, I decided to give veSolid NFT a try and allocated 100 NFT, with this I voted 100% for Tomb-FTM LP and received bribes. Based on prices from a few days ago the yield was 3.1% (weekly), extrapolate this to a year and you get a decent >160%, paid in the tomb.

Now I'm not sure where the fees went as it says in the docs that the fees go to the veSolid lockers and only for the pool you voted for. I don't know if you have any info there?

the next part is what to do with the bribes in my case the tomb I got was compounded to my ftm-tomb LP on solidex which is giving me more solidity and sex. I keep the solid and add it to my NFT and sell the sex for more solid or grave and repeat the cycle.

For me this strategy is low risk, since my NFT is not being diluted, it would seem to me that under this dynamic my performance with the bribes and the fees would increase in the future, in contrast I imagine that the APRs of the pools will stabilize and will be 2 or 3 digits maximum.

Any Thoughts?