The Weekly Trifecta #2: 7/9 - 7/15 - Oracles, Oracles, Oracles...

Breakdown & Analysis of Under-the-Radar News from the Past Week

Welcome to The Weekly Trifecta

gm! Welcome to the second edition of The Weekly Trifecta, a weekly newsletter where I will be breaking down and analyzing three different under-the-radar events from the past week in the crypto industry. The goal of this newsletter is to cover small events that typically do not get pick up by major crypto news outlets, and not large events such as SEC lawsuits or BTC ETF filings.

Please feel free to subscribe for future editions of the Weekly Trifecta and share this post if you enjoy it!

Rodeo Finance: Liquidity Pools Exploited

Rodeo Finance is a yield protocol on Arbitrum that enables users to gain leverage on liquidity provision positions for various third-party protocols such as GMX, Camelot, Trader Joe, and more.

| Website | Documents | Twitter | Blog |

Breakdown

Another week, another DeFi exploit. On July 11, 2023, Rodeo Finance was exploited for ~$880K (~472 ETH) just 1 week after its RDO token went live. The attack was enabled by a faulty price oracle for unshETH price feed on Camelot. The attacker successfully sandwich-attacked the unshETH pool on Camelot, thereby artificially increasing its price. The attacker then drained all liquidity from Rodeo Finance by using unshETH as collateral for loans.

After the attack, Rodeo Finance was left with a shortfall of ~$880K. The protocol aims to pay back this amount by using a portion of the proceeds it generated from its public sale on Camelot that ~$1.06 million. Furthermore, a portion of this shortfall will be paid using “RDO, xRDO, or other RDO derivatives.”

Since the hack, all pools for Rodeo Finance have been paused. Rodeo Finance plans on re-opening some pools third-party auditors can verify that they are safe to use again. Lastly, future product releases and initiatives, such as silos, airdrops, and token rewards, are paused indefinitely until the redeployment of the protocol.

Analysis

According to DefiLlama, Rodeo Finance had a TVL of ~$1.76 million at the time of the hack. Now, TVL sits at $0.38. It goes without saying that this is a major setback for the nascent protocol. It is extremely rare for new projects that suffer hacks like this one to bounce back. This has been reflected in the price of the RDO token as it is down over 60% in the past week.

On the bright side, Rodeo Finance does have the necessary funds to, at a bare minimum, give ample recovery for users that lost funds in the attack. A full repayment of what was lost should help regain some trust lost by its users. Additionally, further security analysis by audit firms is a welcomed sight. If Rodeo Finance were to stage a comeback, these are the necessary first steps.

Ajna Finance: Protocol Launch

Ajna Finance is a governance-free lending protocol that does not utilizes oracle solutions such a price feeds to facilitate liquidations.

| Website | Documents | Twitter | Discord |

Breakdown

Speaking of oracle exploits, the Ajna Finance protocol launched last week on July 13, 2023. Most lending protocols, such as Aave, utilize both price feed oracles and community governance to facilitate their lending & borrowing markets. Both of these features introduce a unique set of risks for both lenders and borrowers. For example…

Oracle Manipulation Attacks - Oracle Manipulation Attacks typically involve the manipulation of the price of a low-liquidity asset to make a lending protocol issue ‘bad-debt’ loans.

Prominent examples include the Mango Markets Exploit, Lodestar Finance Exploit, & Inverse Finance Exploit.

Governance Attacks - Governance attacks typically involve utilizing a protocol’s governance system to unfairly liquidate loans or steal user funds. Although not as common as oracle manipulation attacks, they can prove costly for a protocol. One of the most prominent examples of this attack is the Beanstalk Exploit.

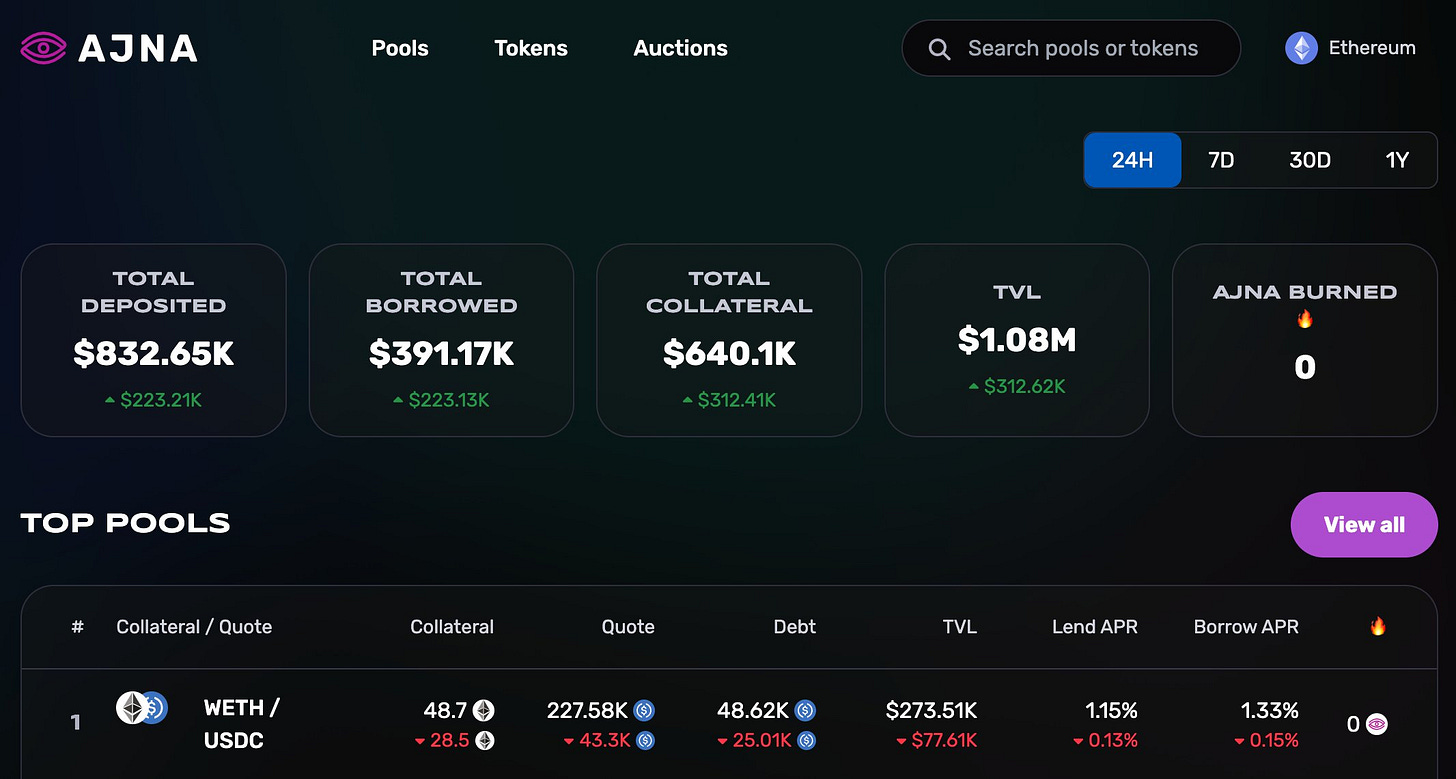

Ajna Finance eliminates these types of risks by completely removing oracles and community governance. It deploys immutable smart contracts (parameters of the contracts can’t be changed) and relies solely on the balance of assets within a lending pool to determine the health of loans. Additionally, it supports markets for all ERC-20 tokens, and even NFTs can be used as collateral. According to DefiLlama, Ajna Finance has attracted ~$4.62 million of deposits and has facilitated ~$1.72 million borrows as of writing.

Analysis

Ajna Finance offers an innovative approach to lending markets with its oracle-free solution. While it certainly eliminates the aforementioned risks above, it introduces greater complexity for the lender and borrower. The best comparison I can think of is that Ajna Finance is the ‘Uniswap V3’ of lending protocols. Why? Because Ajna Finance allows lenders to only lend out at specific price ranges (also known as buckets).

If I’m a lender, I can choose to lend out USDC specifically when ETH is in the price range of 1500-2000 USDC. The worst case in this scenario is that my USDC deposits will be exchange for ETH collateral at an exchange rate of 1 ETH/1500 USDC. This is opposed to a lending system like Aave, where I will be providing liquidity for USDC loans at all price points (similar to Uniswap V2).

It will be interesting to see if Ajna Finance can capture market share for lending protocols as well as Uniswap V3 did for DEX protocols. I’m not sure Ajna Finance will supplant the lending markets for highly liquid tokens such as ETH and major stablecoins, as the oracle risks for those markets are greatly reduced. However, Ajna Finance may be able to capture meaningful market share for more illiquid tokens, as that is where oracle risks are at their highest.

Finally, if there are any exploits or faultiness within the contracts deployed by Ajna Finance, the contracts must be re-deployed. This is certainly a concern as the project’s last audit found 11 ‘high-risk’ items.

Yearn Finance: Staked ETH Solution Launches

Yearn Finance is a yield aggregator that allows users to deposit yield-bearing assets into automated solutions that aim to achieve the highest yield possible on deposits.

| Website | Documents | Twitter | Blog |

Breakdown

The LST market just got a new competitor. On July 14, 2023, Yearn Finance opened up ETH deposits for its new yETH LST. Yearn Finance is taking a different approach to LSTs as its yETH token will be a basket of other ETH LSTs.

yETH holders can determine the basket of LSTs by staking yETH as st-yETH. st-yETH tokenholders get to vote for which LSTs they want to see included in the basket of assets for yETH.

yETH also introduces a bribe market, similar to veCRV’s bribe mechanism. Any user or protocol can post bribes to incentivize st-yETH tokenholders to vote for a specific LST.

All in all, Yearn Finance’s yETH aims to maximize yield on staked ETH through its bribe system while also mitigating risk through using a basket of LSTs. While deposits are now open, yETH’s next phase of voting will go live on July 27, 2023.

Analysis

Yearn Finance’s launch of yETH flew under the radar, I couldn’t recall a single tweet about it while conducting research on it for this post. Lack of attention also has the bribe market off to a slow start, as only ~$430 of incentives have been posted thus far. Nearly ~$1.2 million of ETH has been deposited, so perhaps the number of bribes will increase within the next 11 days.

Nevertheless, I’m not quite convinced that the bribe mechanism for yETH is necessary. The most successful bribe market to date, veCRV’s bribe economy, works well because Curve is providing both the 1) infrastructure and 2) liquidity. For the case of yETH, only liquidity is being provided. Now, this system could work if yETH attracts significant ETH deposits, but why should it?

The yield for different LSTs shouldn’t differ much between one another as the yield is coming from the same underlying source (ETH staking). Marginal yield will come purely from bribe incentives, but will that be enough to compensate the risk for going from Lido’s stETH to an upstart’s staked ETH token that hasn’t been battle tested? I don’t think so.

We’ll see how Yearn Finance’s yETH product will pan out, but as of now, I’m not too optimistic on its outlook.

Until Next Week…

If you’ve made it this far, I’d like to personally thank you for reading! If you enjoyed, please feel free to subscribe, share this, and leave some comments. Additionally, if you really enjoyed, also feel free to donate!

0x7ba9aa5E4caD26EA5E8ba4AC286E5d38Af91F62b

All the content I put out is free, so your donations are greatly appreciated! I’ll see you again on 7/24 for the third edition of The Weekly Trifecta!

Disclaimer: I am not a financial advisor. This website's content is for entertainment, informational and/or educational purposes, whereby, I express my own personal opinion. Nothing contained herein constitutes a solicitation, endorsement or offer to buy/sell any financial instruments, crypto-currencies and/or securities. In order to make the best financial decision that suits your own needs, you should conduct your own due diligence & pertinent research. Keep in mind, all investments involve a likelihood of risk & there is no guarantee that you will be successful in your investment.