The Dopex Stablecoin Part 2: Evaluating dpxUSD and its Implications for rDPX

Creating a Valuation Framework for dpxUSD and rDPX

Introduction

Welcome anon! This is the second part of a two-part series covering Dopex’s impending stablecoin called dpxUSD. Before reading any further, make sure you’ve checked out the first part by Degen Sensei. While the first part will teach you about the mechanics of dpxUSD and how it fits within the Dopex ecosystem, this part will try to evaluate the potential supply of dpxUSD and its effect on rDPX. In order to fully grasp all of this, it really is imperative you read Degen Sensei’s piece first, so don’t forget to do that!

Welcome to the Average Joe’s Crypto and we hope you enjoy our analysis and evaluation of Dopex’s stablecoin! If you do, please feel free to give this post a share as it is greatly appreciated!

Additionally, if you want to make sure you don’t miss out on any future content, make sure to subscribe to this Substack as well!

Creating a Valuation Framework

How do you place a value on something that hasn’t even been released?

That was the first question we asked ourselves after reading the rDPX v2 whitepaper. While this seemed like an impossible task at first, we believe we have found a possible framework to estimate the supply of dpxUSD, and by extension, possible market caps for rDPX. How were we able to do this? Well, it all starts with crypto’s most famous anon whale: Tetranode.

As you may or may not know, Tetranode has been heavily involved with Dopex. He’s gone so far as even stating that it is one of his highest conviction investments. What you also may or may not know is that Tetranode controls a large stack of veCRV. Why does this matter? It matters because Tetranode himself has said that he will be using his veCRV to strongarm dpxUSD onto Curve Finance.

If you are unsure of how Curve Finance works, I highly recommend checking out this post we did which goes over in-depth both Curve Finance and Convex Finance (LINK). With this 15M veCRV in firepower, Tetranode can heavily incentivize a dpxUSD pool on Curve once it releases. The higher the gauge weight, the higher the CRV emissions which go to the dpxUSD pool. These CRV emissions will incentivize Liquidity Providers (LPs) to acquire dpxUSD and enter the pool in search of higher returns. The only problem which remains is just how much is 15M veCRV?

Finding the answer to this was actually much more difficult than we imagined. There is no good resource out there which compiles the amount of veCRV which votes every period. As such, we had to estimate how much voting power the 15M veCRV correlates to. Thankfully, Convex Finance (The largest owner of veCRV), does have data which shows how their veCRV votes each period. Using this and comparing it to the actual Curve Finance gauge weights, we can get a low estimate of voting for veCRV. For the high estimate, we can just assume that all veCRV votes each week. Here are the numbers laid out:

From this, we can see that Tetranode’s veCRV should correlate to a gauge weight in the range of 3.70% - 4.15% for dpxUSD. From just knowing the possible gauge weight of this pool, we can both estimate dpxUSD’s supply and place a valuation on rDPX. Before running the numbers, we’re going to walk through the process first as it could get a little confusing.

Estimating dpxUSD Supply

As previously stated, the higher emissions a pool on Curve receives, the more capital which flow into it. To put it simply:

⬆️ Higher Emissions = ⬆️ Total Value Locked in Pool.

The first step is to collect data on already existing stablecoin pools, specifically how much in emissions they receive and how much capital is in their pools. Divide emissions by the TVL, and you arrive at a number which tells you just how much in TVL is generated by $1 in emissions. From this Emissions/TVL metric, we can compare it to what the projected emissions for the dpxUSD is and arrive at a TVL for the pool.

Since dpxUSD will only be one side of the pool, it should make up roughly ~50% of the TVL. By dividing the projected TVL of the pool by 2, we arrive at an estimate for the supply of dpxUSD.

Estimating rDPX Market Cap

From this estimated supply of dpxUSD, we can also estimate what the market cap of rDPX might be. This because of the relationship between dpxUSD and rDPX:

1 dpxUSD = $0.75 in stables + $0.25 rDPX

Therefore…

Market Cap of rDPX >= .25 Market Cap of dpxUSD

The market cap of rDPX must stay above that .25 ratio. Otherwise, dpxUSD runs the risk of a depeg + bank run event. Additionally, rDPX should trade at a premium to this .25 ratio. This is for two reasons:

Premium will be necessary to absorb sell pressure from a mass redemption event.

Premium will incorporate market expectations of future growth of dpxUSD. Higher premium = Higher expected growth of dpxUSD.

The formula for the market cap of rDPX is actually this:

Market Cap of rDPX = .25 Market Cap of dpxUSD + Market Premium

Estimating the market premium is a slight challenge, but luckily there are other algorithmic stablecoins which we can use as comparisons.

Running the Numbers

Now that we have laid out the framework for how we are going about evaluating all of this, it is time to run the numbers! Let’s start with the supply of dpxUSD.

dpxUSD Supply Projections

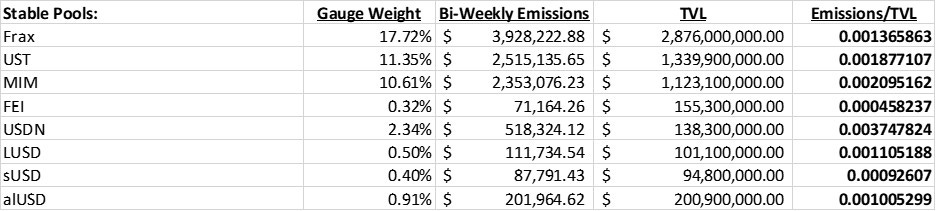

We chose to compare dpxUSD to all other decentralized stablecoins with a TVL of at least $90 million. That list includes FRAX, UST, MIM, alUSD, FEI, USDN, LUSD, and sUSD. Compiled metrics are Gauge Weight, Bi-Weekly Emissions, TVL, and Emissions/TVL. Here is the data:

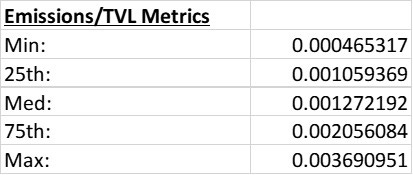

The important data point is Emissions/TVL, so here are the metrics on that:

Again, these metrics are the most important. We will use them as comparison to backout the TVL of the dpxUSD pool. The other factor at play is the gauge weight for the pool. Since we have two factors, we can put together a sensitivity table to arrive at some estimates for the supply of dpxUSD:

From this, we arrive at a range of values from ~$211m to ~$881m with a middle estimate of ~$350m. Remember, those values shown are for the supply of dpxUSD and assume that dpxUSD makes up 50% of its Curve pool.

rDPX Market Cap Projections

With dpxUSD supply projects, we can also project out what the market cap of rDPX should be. But first, we need to try and figure out what the premium should be. To do this, we will use the LUNA premium over UST and the FXS premium over FRAX. Since Frax is only a partially algorithmic stablecoin, the premium is adjusted to reflect the collateralization ratio of Frax at the time. Additionally, we used the last 90 days of market data to get metrics on these premiums. Here are the LUNA and FXS Premiums:

We can see that the market placed similar premiums with a typical range of ~2x - ~3x on these two assets over the past 90 days. As an aside, premiums tend to shrink during bear markets and expand during bull markets. On top of that, market premiums are generally greater for smaller and newer projects as evidenced by the fact that the LUNA premium over UST has continuously shrunk over the past year.

To come up with a valuation for rDPX, we will put together another sensitivity table. For this table, the two factors are the Premium Multiplier and the Emissions/TVL Multiplier. For simplicity, we will assume that the dpxUSD pool has a gauge weight of 4.0%. Here are the ranges of possible market caps for rDPX:

The numbers highlighted in green are greater than the market cap as of writing, which is $118,459,192. Red highlighted numbers are less than the current market cap. Based on this analysis, we think it is pretty safe to say that the market is incorrectly pricing in the launch of dpxUSD for rDPX. Markets are inefficient in crypto, and especially for smaller cap projects. Even at a baseline valuation of $221.8M (Which is at pretty conservative estimates), rDPX would pull a ~87% gain in market cap terms from here.

Other Considerations

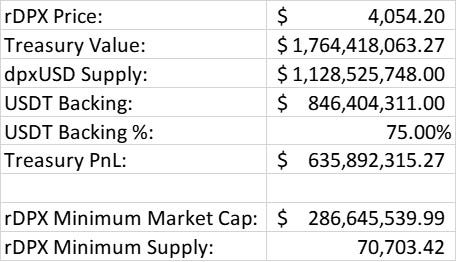

You’ve probably noticed by now that all our valuations are for the market cap of rDPX, not the price of an rDPX token. This is because price is much harder to calculate as there are many more moving parts. Whenever dpxUSD is minted, an equal $ amount of rDPX is burnt. This is challenging for calculations since supply is decreasing and the rate at which it decreases by is dependent on the price of rDPX. However, because of this, the price of an rDPX token should increase at a greater % than the market cap of rDPX. Founder of Dopex, TzTok-Chad, has made public an internal Dopex analysis of rDPX price:

The minimum market cap and minimum supply is what we backed out from that analysis based on the formula: rDPX Market Cap = .25 of dpxUSD Supply. One thing you might be wondering about the TzTok-Chad model is: “How does that model arrive at a supply greater than 1 billion for dpxUSD?” There are two things in particular we want to point out. Firstly, if we’re not mistaken, that projection spans over the course of a year. Our projection, on the other hand, is geared for the short to medium term.

Secondly, and perhaps more importantly, Tetranode’s 15M veCRV might not be the only veCRV voting for the dpxUSD pool. Tetranode has already stated that he will be selling 500K CVX OTC to Dopex once dpxUSD is ready to launch. It is not clear if this number is already included in the 15M veCRV, but if it is not, that would be an additional ~2.3M veCRV voting for the dpxUSD pool. If that wasn’t enough, Dopex is also expected to bribe CVX lockers to vote for the dpxUSD pool. While it is not yet disclosed how much they will be bribing, the Dopex Multisig Treasury has 234,909 DPX in its control. At current market prices, that is around $280 million. Dopex certainty has the firepower to enter the bribe wars if they choose to do so.

Conclusion

Based on our own analysis and the aforementioned other considerations, we feel that rDPX provides great value at these levels. Obviously, there are risks involved with the greatest risk being the outright failure of dpxUSD. However, we have faith in the Dopex team and will not be betting against them. If you couldn’t tell by now, we are extremely excited for the launch of dpxUSD and are quite bullish on rDPX with the upgraded v2 tokenomics.

Before wrapping things up, I just want to thank Degen Sensei for collaborating with me on this effort. Please make sure to both give him a follow his Twitter and subscribe to his Substack!

That’s all we got for this post! A lot of work, research, and effort went into the making of this. If you found it helpful and would like to donate, you can do so at our Ethereum/Arbitrum Address:

0x7ba9aa5E4caD26EA5E8ba4AC286E5d38Af91F62b

All the content we put out is free, so your donations are greatly appreciated!

Thank you for taking the time out of your day to give this post a read. Your support really means so much to us! If you enjoyed this post, please help us spread it around by giving it a share! If you want more content like this, why not subscribe? You won’t regret it! If you have comments, questions, or concerns, please feel free to either comment them or hit us up on Twitter. Once again, thank you and we hope you enjoyed!

Disclaimer: We are not financial advisors. This website's content is for entertainment, informational and/or educational purposes, whereby, we express our own personal opinion. Nothing contained herein constitutes a solicitation, endorsement or offer to buy/sell any financial instruments, crypto-currencies and/or securities. In order to make the best financial decision that suits your own needs, you should conduct your own due diligence & pertinent research. Keep in mind, all investments involve a likelihood of risk & there is no guarantee that you will be successful in your investment.

So decentralisation relies on accumulating loads of governance tokens so one/a few can manipulate the result they want ... genius.

Tetrachungus will lead us to the promised land. Away from wagecuck despair lol