The Curve Wars Go Hot

The announcement of the 4pool stands to forever change the landscape of the Curve Wars

Introduction

Back in January, we made a post analyzing Convex Finance. If you are unfamiliar with that post, you can check it out here. Anyways, to introduce our readers to Convex Finance and its role within the Curve Wars, we repurposed a riddle from one of our favorite book series, A Song of Ice and Fire. Allow us to reintroduce you to that riddle:

“In a room sit three great men, a king, a priest, and a rich man with his gold. Between them stands a sellsword, a little man of common birth and no great mind. Each of the great ones bids him slay the other two. ‘Do it,’ says the king, ‘for I am your lawful ruler.’ ‘Do it,’ says the priest, ‘for I command you in the names of the gods.’ ‘Do it,’ says the rich man, ‘and all this gold shall be yours.’ So tell me – who lives and who dies?”

This riddle, posed by the mysterious Lord Varys, is meant to be a hypothesis of sorts on the idea of power. Varys is proposing that power does not come from money, religion, birthright, etc. but rather power simply comes from where we as a society collectively decide it does. Getting back to crypto, the sellsword in this riddle was liked to Convex vote-lockers. When you vote-lock your CVX, you ultimately have a say in where CRV emissions go. The more CVX and CRV one holds, the more power over DeFi one wields. Varys’ riddle is a great inquisition into the idea of what power is, but there is one major problem with it:

Why do the king, the priest, and the rich man all want to kill each other?

Power is the ultimate goal in this riddle. Each great man is seeking more power, but is it wise to let the sellsword decide who gains that power? Why leave your fate to a game of chance? What the three great men should really do is all work together and use the sellsword to do their biddings. This way, the three great men gain some incremental power without the threat of losing all their power.

What transpired this past Friday is essentially that. The three great “men”, Terra, Frax, and [REDACTED] Cartel, turned the power riddle on its head and decided to team up. Their joint venture, the 4pool, will forever change the nature of the Curve Wars.

Welcome to the next phase of the Curve Wars.

A New Weapon of War

If you made it this far, we’re going to assume you have at least some understanding of what the Curve Wars are. If not, go check out Knower's Substack where he has two great pieces going over them in depth. You can find the first one here and the second one here. Moving on!

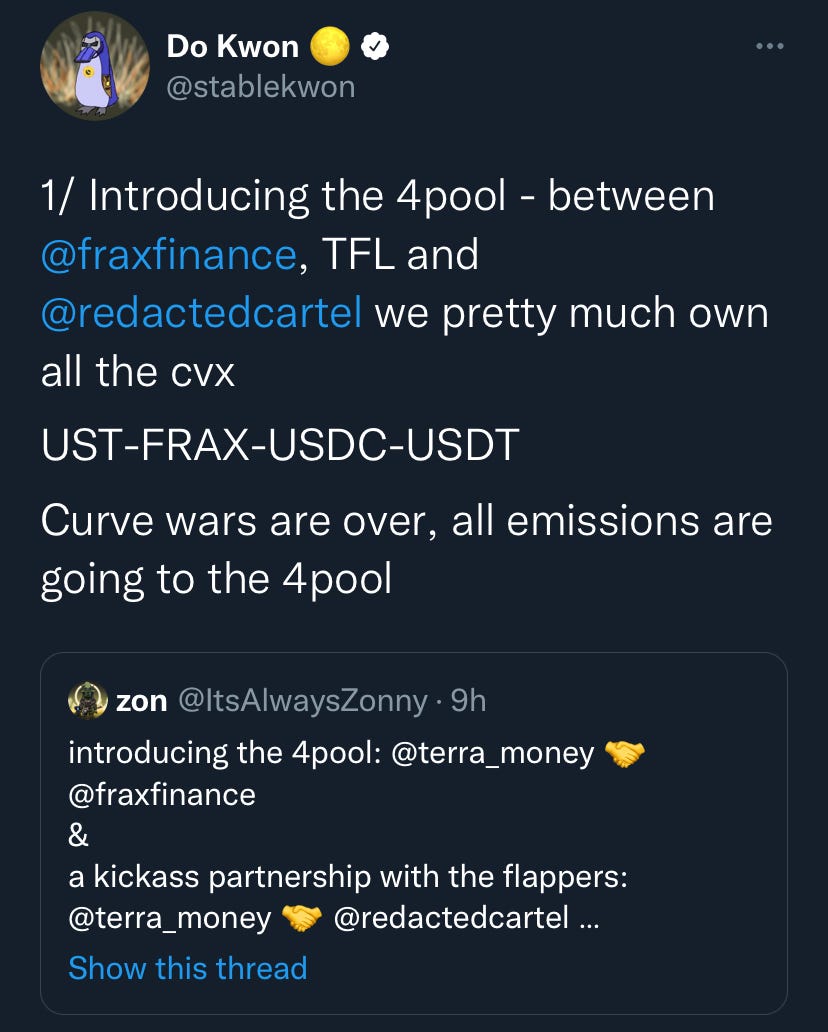

Over the past couple weeks, Terra’s founder, Do Kwon, has become one of the most polarizing figures of the crypto space. From making million-dollar bets to helping pump the price of Bitcoin, Do Kwon has been turning the crypto markets into his own personal playground. As our friend Ace da Book puts it, Do Kwon is asserting himself as the Jeff Bezos of crypto. Now, whether or not you agree with that is besides the point. What matters is that Do Kwon and Terra are now MAJOR players in this space, and they can simply not be ignored. On April 1st (No, not an April Fool’s Joke), Do Kwon and Terra announced their latest shakeup of the crypto space.

You can read the full proposal for the 4pool here but allow us to briefly explain what it is in our own words. The largest and most important pool on Curve has always been the 3pool. The 3pool contains 3 stablecoins: USDT, USDC, & DAI. In just this one pool alone resides almost $3.4 billion. 3pool is critical infrastructure for maintaining peg between USDT, USDC, & DAI, and by extent, critical for DeFi. Additionally, in part because of 3pool, USDT, USDC, and DAI have historically always been the most prominent stablecoin options.

Terra’s UST and Frax’s FRAX are the new guys in town and they’re looking to leave their mark. You see, what you have to understand about UST and FRAX is that they’re decentralized algorithmic stablecoins. Maintaining their stablecoin pegs is a lot more difficult as they do not have real dollars backing them as in the case of USDC and USDT. If peg can’t be maintained, no one is going to use your stablecoin. Driving liquidity to your stablecoin pools on Curve is arguably one of the best ways to maintain peg for a stablecoin. The higher the liquidity, the stronger the peg is.

However, Terra and Frax aren’t just gunning to maintain their stablecoin pegs, they’re aiming to cement their stablecoin products as the premier decentralized stablecoin options. The 4pool will consist of UST, FRAX, USDC, & USDT. Odd man out? DAI. As you can probably tell by now, the purpose of the 4pool is replace the 3pool, effectively replacing DAI.

Why kill DAI? Well, other than Do Kwon’s own personal vendetta against DAI, there are some issues with DAI. The problem is DAI is a “decentralized” overcollateralized stablecoin. Let’s start with the lesser problem of the two: overcollateralization. How DAI works is that is backed by a variety of assets. To ensure peg, each DAI requires more than $1 in assets backing it. This overcollateralization becomes an issue when trying to scale. Overcollateralized stablecoins are stable, but inefficient when it comes to scaling to widespread stablecoin use.

The larger issue with DAI is its “decentralization”. As previously mentioned, DAI is backed by a variety of assets. The largest one? USDC. This raises some serious concerns over the decentralization of DAI. Can a stablecoin be decentralized if it has major backing from a centralized stablecoin? That is up to you to decide, but there are obviously centralization concerns when it comes to DAI. If Circle blacklisted all the USDC backing DAI, what would happen to the stability of DAI?

Terra and Frax are serious about replacing the 3pool, and they have the firepower to do so. Frax is the largest DAO holder of CVX, clocking in at 2,130,752 CVX. Terra is not too far behind with 1,665,183 CVX. And oh yeah, their other partner, Redacted Cartel, owns 1,424,457 CVX. All together, they control 12.03% of all vote-locked CVX which translates to 24.5 million veCRV. If that wasn’t enough, Frax and Terra are also the two biggest bribers of CVX. Last round, Frax used $6.57 million and Terra used $4.26 million to bribe vlCVX holders to vote for their pools. By conjoining forces, Terra, Frax, and Redacted stand to replace the 3pool and make the 4pool the most important DeFi infrastructure for decentralized and centralized stablecoin liquidity.

A Cold War Goes Hot

Sorry Do Kwon, but there is one thing you got wrong: The Curve Wars are not over. The 4pool is merely bringing the Curve Wars to the next phase of war. In retrospect, the Curve Wars of late 2021 should be considered a cold war. Protocols, DAOs, and whales were all fighting for control over Curve, but those participants all had one goal in mind: profit. Curve was a money machine, and everyone wanted to get a hand on those juicy emissions. Now, however, the game has changed. The goal is now survival. And when one’s survival is on the line, you can guarantee that they’re going to fight like hell to maintain it. The 4pool did not end the Curve Wars, it just turned a cold war into a war of survival.

Terra, Frax, and Redacted control a lot of CVX, but they don’t control enough CVX. Their 12% control will certainly drive large emissions to 4pool, but most likely not enough to kill off 3pool. We’d imagine that to make up for this, Terra and Frax will be ramping up their bribes for 4pool. 8-figure bribes for 4pool will be here before you know it, and we’d reckon that the all-time-high of $0.87 per vlCVX will be broken in the coming weeks. On top of all this, Terra and Frax will have to continue to increase their CVX holdings. You come at the king, you best not miss.

If you’re MakerDAO, what do you do in this situation? Do you stand idle and slowly let 3pool and DAI die off? Or do you devote whatever resources you can spare to help support the 3pool? If we’re Maker, we definitely go with the latter of the two options. If Maker is serious about DAI, they are left with no choice but to enter the Curve Wars. War has been declared on them, and it would be ill-informed not to fight back.

Currently, MakerDAO controls a treasury worth $259 million, consisting of 83K MKR, 67.9M DAI, 46.3K ENS, and 782 stkAAVE. Perhaps it is time for Maker to allocate some of these treasury funds to CVX? In addition to its treasury, Maker also runs a profit of $68 million annually. Right now, these profits are used to buy back and burn MKR. If Maker is serious about defending 3pool, then maybe they should start using some of those profits to bribe vlCVX holders instead. If Maker decides to not defend DAI and 3pool, it will go down as one of the biggest miscalculations in the history of crypto.

Although this current iteration of the Curve Wars will mainly involve the 4pool and the 3pool, that doesn’t mean every other Curve War participant will just sit idly by and let these two behemoths play it out. As with all wars, there is much more going on behind the curtains. The announcement of the 4pool was an ‘Oh Shit’ moment, and every player now must reposition themselves. Don’t think they aren’t? One of the largest CVX whales, Tetranode, is subtly reminding everyone that he too owns a huge stack of CVX.

We wonder what he is up to…

And lastly, there are more decentralized stablecoins out there than just UST, FRAX, and DAI. If other stablecoins such as MIM, FEI, alUSD, etc. don’t want to get left behind in the dust, they too need to ramp up their Curve Wars efforts. With Terra, Frax, and Redacted throwing tens of millions of dollars into the Curve Wars, it forces all other players to increase their own spending. Otherwise, they die. Over the coming weeks and months, we fully expect the Curve Wars to ramp up in such a way that it will make the original Curve Wars look like nothing.

Conclusion

In our first post on Convex, we came to a value of ~$250 per CVX. The path to $250 obviously includes the continuation of the Curve Wars and increasing bribes, and the launch of the 4pool should only supercharge this narrative. The Curve Wars are back and will be bigger than ever. Over the past few months, the narrative has shifted away from CRV and CVX. Over the coming weeks, we believe that CRV and CVX will reassert themselves as the apex DeFi assets. Before we wrap this up, we just want to point out the fact that there is only ~5.2 million CVX for sale. You can do the math yourself, but to us, it seems like there’s only place for CVX to go. We will be positioning ourselves accordingly.

If you’ve made it this far, we’d like to thank you for taking the time out of your day and giving this a read. If you enjoyed, please consider donating to this address:

0x7ba9aa5E4caD26EA5E8ba4AC286E5d38Af91F62b

All of your donations are greatly appreciated!

Well, that’s all we have for today. As always, if you enjoyed this post, please help us out and give it a share! If you don’t want to miss any future content, don’t forget to subscribe! If you have any questions, comments, or concerns, please feel free to leave us a comment. And as always, don’t forget to give us a follow us on Twitter! Once again, we want to thank you for reading this post and hopefully you enjoyed!

Disclaimer: We are not financial advisors. This website's content is for entertainment, informational and/or educational purposes, whereby, we express our own personal opinion. Nothing contained herein constitutes a solicitation, endorsement or offer to buy/sell any financial instruments, crypto-currencies and/or securities. In order to make the best financial decision that suits your own needs, you should conduct your own due diligence & pertinent research. Keep in mind, all investments involve a likelihood of risk & there is no guarantee that you will be successful in your investment.