Introduction

Lately, a lot of our efforts have been focused on Terra and its ever-growing ecosystem. As much as we love diving deep into individual protocols and cryptocurrencies, it is important to take a step back sometimes and look at the bigger picture. The crypto market is big, and it could be daunting for a first-time investor. In this post, we aim to highlight some important rules that every new investor should adhere to in crypto. Even if you’re an experienced investor, sometimes it is good to take a step back and reevaluate your investment strategy.

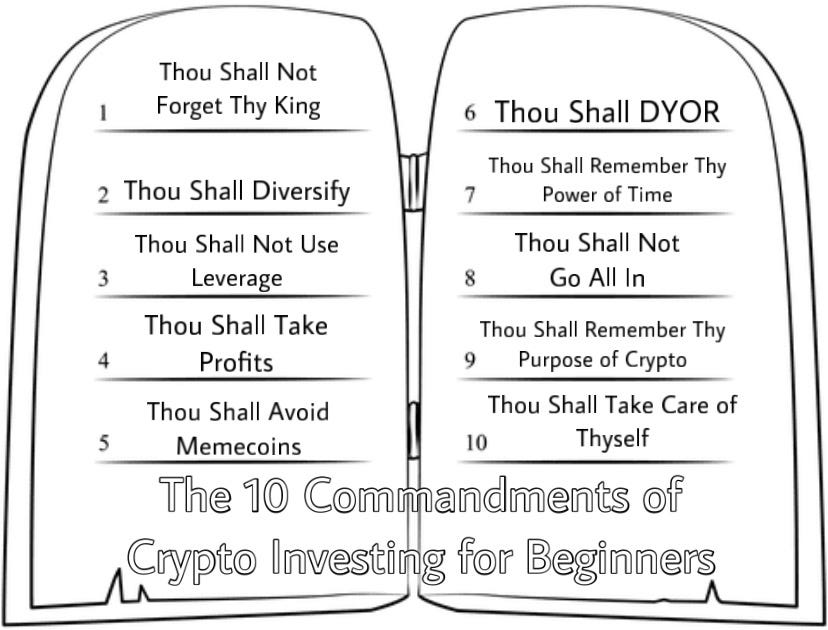

If you enjoy what we put together in this post, feel free to subscribe and share it! Additionally, if you know anyone who is looking to invest in crypto, send this article their way as it could be extremely helpful! Without further ado, here is The Average Joe’s Crypto’s 10 Commandments of Crypto Investing

1) Thou Shall Not Forget Thy King

In the world of crypto, there has always been one King. And the King’s name is Bitcoin. Ever since Satoshi Nakamoto created Bitcoin back in 2009, Bitcoin has remained the #1 cryptocurrency by far. Although rumblings of a flippening, the possibility that Ethereum may one day overtake Bitcoin in market cap, grow louder and louder every day, the fact of the matter is that Bitcoin is still the most important crypto asset. Thus, one cannot forget about Bitcoin.

What do we mean by forget? For starters, if you’re a new investor to crypto, Bitcoin should represent a sizeable portion of your crypto portfolio. When you first start off, we think that Bitcoin should represent at least 50% of your portfolio. Although some low-cap altcoins may post much larger gains than Bitcoin, Bitcoin still offers one of the best opportunities in the crypto markets on a risk-adjusted basis. Additionally, it’s the most accessible cryptocurrency as every Centralized Exchange carries it and it has the highest trading volumes. Ultimately, crypto will only go as far as Bitcoin goes for the foreseeable future. Imagine what would happen to the crypto market if a flaw was discovered in the Bitcoin protocol and it crashed to zero overnight (Purely hypothetical, will not happen). The crypto market would take such a huge hit that it would make the bear market of 2018 look like a joke.

2) Thou Shall Diversify

It is important to remember the King, but perhaps it is even more important to remember that a King is useless unless he has a land to rule, and people to follow him. Even though we strongly suggest holding Bitcoin, we also suggest diversifying your holdings beyond Bitcoin. Bitcoin Maximalism, the idea that Bitcoin is the only crypto asset worth holding, is dangerous and will only harm your portfolio. Maxis have missed the following opportunities because they were unopen to the ideas of change: Ethereum, Chainlink, Avalanche, Terra, Axie Infinity, and countless others. Crypto is one of the fastest developing markets, it is constantly changing and pushing boundaries. As great as Bitcoin is, don’t get left behind and miss out on countless opportunities because of the foolish idea that only Bitcoin will matter.

How much should I diversify? When you first start out, your best bet is to keep it simple. You shouldn’t own any more than 10 different coins to start, and we think 5-7 is just fine. After Bitcoin, Ethereum should certainly be your biggest holding. If Bitcoin is the King, then Ethereum would be its Queen. After Bitcoin and Ethereum, there is a lot of debate on what is the next most important portfolio position. Personally, we think that Chainlink should be your 3rd biggest holding, but there are certainly arguments to be made for other coins. Most importantly, you should be diversifying to gain exposure to different segments of the market. You should strive to have holdings in DeFi, NFT/Gaming, Smart Contract Platforms, Oracles, Metaverse, etc. As your time in the market increases and your knowledge expands, increase the reach of your crypto holdings.

3) Thou Shall Not Use Leverage

If you’ve only started paying attention to crypto in 2021, you might think it is a market of incredible ever-lasting gains where everyone is getting rich quick. You may be experiencing some FOMO and want to “catch up” to everyone else. You think to yourself: I should borrow some money and lever up to magnify my gains… Whatever you do, DO NOT BORROW MONEY TO BUY CRYPTO! There a plenty of traders in crypto who use leverage and make significant gains because of it. Don’t get the wrong idea though. You are not one of those traders.

If you’re just getting in to crypto, focus on being an investor. Seriously, don’t try to trade and use leverage. The combination of inexperience and leverage is a surefire way to lose it all. Maybe one day down the line you can successfully use leverage to your advantage, but if you’re just starting out, that day is definitely not today. Buy crypto with money you have, not money you borrowed.

4) Thou Shall Take Profits

One of the sentiments to become mainstream in retail investing over the past year is Diamond Hands- Never selling no matter what. Another phrase for the term, HODL, has been around for years as a mainstay of Bitcoin culture. The time to “diamond hands” or “hodl” your investment is when you buy it in the depths of the bear market with the highest conviction. NOT when it is up thousands of % and mania is at full effect. It is important to take profits when your investments are up significant amounts. You never know when the next bear market will happen, so it may be a good idea to lock in some profits every now and then. Generally, for altcoin investments, we like to take enough profits to cover our cost basis. So, if an investment pulled a 5x, we would sell 20% of our stack.

Taking profits, however, does not mean to sell all of your investment, especially if that investment is in something such as Bitcoin or Ethereum. Never go to zero on an investment you have conviction on. We may or may not be still haunted by the MANA we sold at $0.36 after a comfortable 3x… (MANA is currently trading at $3.37).

5) Thou Shall Avoid Memecoins

Pretty much at every family or friends gathering these days, you’re bound to hear that one weird uncle or that one stone friend brings up DOGE or SHIBA… Don’t be that person. Yes, there are some people who got incredibly lucky investing in those coins and made millions. But let’s call that what it was: Dumb luck. Just because someone else made money off meme coins, doesn’t mean you’ll make money off meme coins.

Our advice here is simple, just avoid them. Don’t even waste your time researching them. It’s just not worth the hassle as an investor. For every successful meme coin, there are 1000 others that failed, were scams, or rug pulls. Focus on investing in high quality cryptos with actual purpose and utility, not some meme coin that you think is funny.

6) Thou Shall DYOR

Before buying any crypto, it is important to Do Your Own Research (DYOR). We can’t stress this enough. No one is right all the time, including us, so you should never blindly ape in to a crypto because your favorite Twitter account said to. You should always try to, at the bare minimum, have a basic understanding of what you're buying before you buy. Although this means you might end up buying later on at a higher price, it will be worth it in the long run as you cut down on bad investments.

Never just blindly trust what someone says to buy, even if its Warren Buffet or Elon Musk. Try to gain an unbiased understanding of what you’re going to buy first. Then decide if that investment is worth it for you.

7) Thou Shall Remember Thy Power of Time

A lot of retail investors hopped onto the crypto markets recently because they viewed it as a ‘Get Rich Quick’ scheme. Ultimately, this is an incorrect view of the crypto markets. In short periods of time, the crypto market is highly volatile. 20% swings in the matter of hours are commonplace, and in both directions. However, zoom out and take a look at the bigger picture.

Time is your friend in the markets. Although Bitcoin and crypto have had its downswings, the overall multi-year trend is up. Do you really think crypto will be worth less in ten years from now then today? If you do think that, why bother investing in the first place? The longer you participate, the better your returns should be. Play the long game and use time your time in the market to your advantage. You are still early.

8) Thou Shall Not Go All In

Whether it be groceries, rent, student loans, your kids, or whatever it is, we all have expenses to pay in life. Do not use money that you need to cover your life expenses to invest in crypto. Importantly, only invest what you can afford to lose. If you’re having trouble sleeping at night, constantly checking charts, and get anxiety over every price drop, you’ve probably invested too much. If your crypto investments dropped by 50% in one day, how would your financials be? Would you be able to pay your mortgage or rent? If not, you seriously need to reconsider how much money you have invested.

9) Thou Shall Remember Thy Purpose of Crypto

“The computer can be used as a tool to liberate and protect people, rather than to control them.” - Hal Finney

In the craziness of the markets that are crypto, where people make millions off of flat-out Ponzi schemes, gamble away their life savings on leverage trading, or are lucky enough to make genuine life-changing money, it is quite easy to forget what the purpose of all this is. “In it for the tech” has basically become a meme at this point (perhaps signaling the euphoria of the markets?), but we still think it is the single biggest determinant for long term success of crypto investors. Cryptocurrencies and protocols that prioritize decentralization, being censorship-resistant, and being trust-less will be the ones that win long term. Sure, centralized coins such as BNB, USDT, and XRP have large market caps right now, but we’re willing to bet that decentralization will win out over the long term. So, before you buy any new coin, ask yourself if it aims to follow the cornerstone principles of cryptocurrency such as decentralization.

10) Thou Shall Take Care of Thyself

Ultimately, cryptocurrencies will not be the source of your happiness. All too often we see people who have made life-changing money but are still depressed and unhappy. This last commandment is a general reminder that money will not solve all your problems. It is important to make sure you are mentally, physically, and emotionally healthy. If crypto is getting in the way of any of these things, maybe it is time to take a step back and reevaluate. It is important to cultivate long-lasting impactful relationships with family and friends, eat healthy and work out, and to take care of yourself. Crypto can be a wonderful place to invest, but don’t let it control your life.

Concluding Remarks

Well, there you have it! This is our advice we would give to those who are just beginning to invest. Disagree with what we said? We’d love to hear your feedback, what you liked, and what you didn’t like. Please comment!

Thank you all for reading this post and we hope that you enjoyed! It would be greatly appreciated if you subscribe and follow us on Twitter. Until next time!

Disclaimer: None of this should be deemed financial advice. It is purely for entertainment purposes only.

Third time reading this article, third time I noticed I'm smiling in the end.

Can't wait for the second part of ve(3,3) to drop. Keep up the great work!

Shout out to

theknower.substack and incentivized.substack cuz I think that's how I ended up here