Overview and Analysis of Babylon Finance: Asset Management Meets Crypto

A new DeFi protocol that aims to capture the rise of social investing

Disclaimer: This post was done in collaboration with Babylon Finance. For my efforts, I received compensation from Babylon Finance. However, the team behind Babylon Finance was adamant that I be completely objective, good or bad, in the writing of this post. As such, the contents of this post contain my own personal analysis and opinions regarding Babylon Finance and other related matters.

Introduction: The Rise of Social Investing

Human beings, by our own very nature, are social creatures. Ever since the days of hunters and gatherers, humans have naturally formed groups and tribes with one another in order to best accomplish their needs and goals. To put it simply, it is in our blood.

Perhaps the single greatest invention to allow humans to capitalize on this innate desire to be a part of a community has been the internet. With the internet, humans are no longer bounded by geography to form communities with others who share similar interests or skills. As more and more of the world goes digital, it is safe to assume that humans will continue to form social groups around the things they love.

Over the past few years, one such example of this has been social investing. If you took part of the meme stock craze in 2021, you know what I’m talking about. Seemingly overnight, millions and millions of people bought into GME and AMC and joined Reddit communities such as wallstreetbets. The possibility of outlandish gains was not the only thing that attracted many to partake. For many, it was the sense of community that formed around this flash in the pan that enticed them to join. Social investing means that investing is no longer just about gains and losses, but about who you share your gains and losses with.

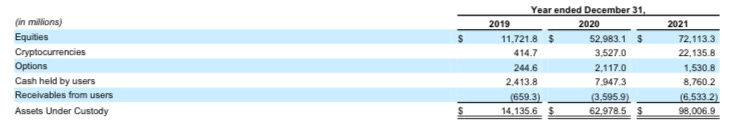

No company has better captured this rise of social investing better than Robinhood. Regardless of your opinions on the company, it is undeniable that Robinhood has built its brand on this idea of social investing. Its easy-to-use platform combined with its various rewards programs attracted millions of users. As of December 2021, Robinhood users had $98 billion worth of assets on the platform. Of that $98 billion, $22 billion is in cryptocurrencies.

Now, you’re probably a bit confused why I’m talking about Robinhood when this post is supposed to be about Babylon Finance. The point I am trying to illustrate is that the market for social investing is HUGE. And as you know, there has been no ‘Robinhood of Crypto’ yet. Social investing is existent in crypto, but no project or protocol has been able to truly capture that market like Robinhood did for retail investing. The opportunity is there, now the question is who will be able to capitalize upon it? It is this question which serves as the basis for my interest in Babylon Finance. Will it be successful? Who knows, but it is one of the only protocols I know of which is actively trying to capture this market. Because of this, it certainly worth a deeper dive and analysis.

Babylon Finance: What is it?

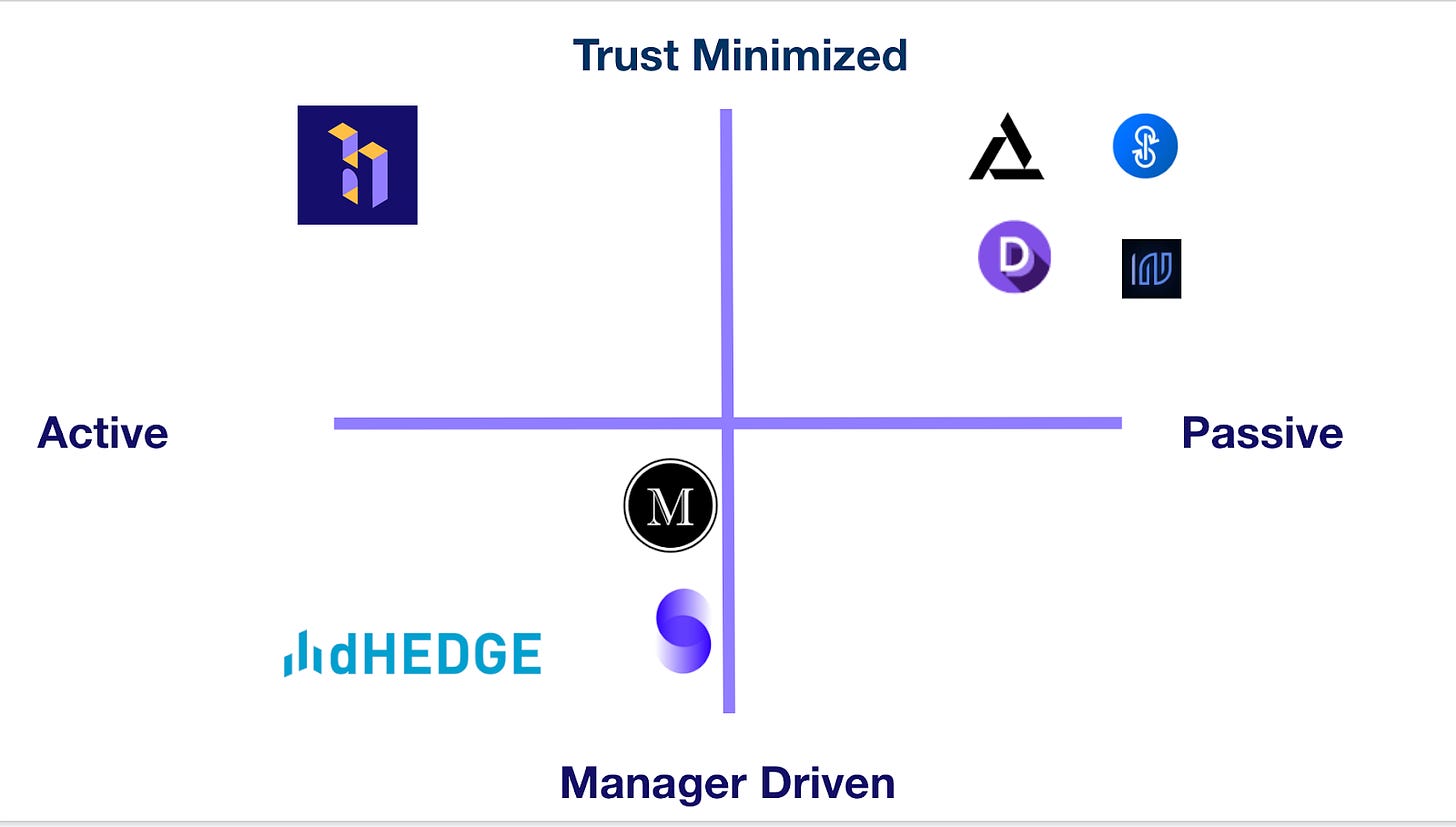

Babylon Finance is a community-led and non-custodial asset management protocol built on Ethereum. Babylon is certainly not the first asset management protocol to be built on the blockchain. Others include Yearn Finance, Indexed, Enzyme, etc. However, with these asset management protocols, there is typically a trade-off when it comes decentralization and the complexity of the investment strategy.

Babylon Finance differentiates itself by being a protocol which can both utilize active investment strategies while maintaining decentralization and minimizing trust. Babylon aims to achieve this through the use of Gardens.

Gardens

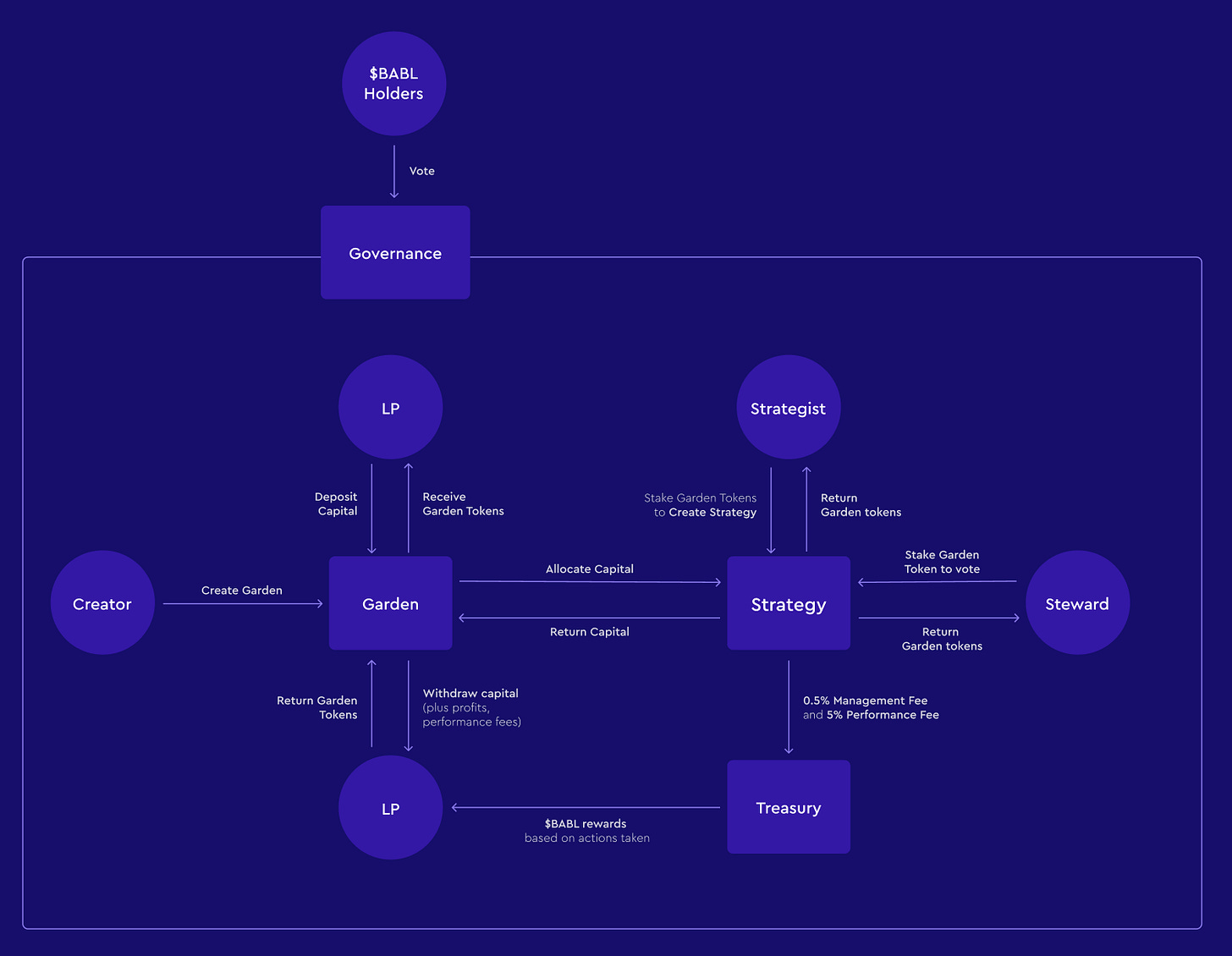

Gardens are the investment communities of Babylon Finance. To join a Garden, all one has to do is deposit the reserve asset (Typically ETH or DAI) of the garden. Once a member, you can propose investment strategies, vote on strategies, and receive rewards for participating in governance of the Garden. Currently, anyone can create a Garden. When creating a Garden, there is a whole host of parameters the creator can set:

Name, reserve asset, and investment thesis

Who can join- Could be a public garden where anyone can join or a private garden where only whitelisted addresses can join

Profit allocation

Deposit minimums and maximums

Early withdrawal penalties

Strategy durations, # of votes to reach quorum, and % needed to activate a strategy

Liquidity thresholds for assets they choose to invest in

Once the Garden is created, the creator of the Garden can no longer change these parameters. Users who deposited capital into the Garden vote on which strategies they want to employ to best execute the investment thesis initially laid out.

Strategies

Those who submit these strategies are Strategists and can receive additional rewards for successful investment strategies. As far as voting goes, your vote share is proportional to the % of capital you contributed to the garden. If you deposited 10% of the total capital, then your vote share will be 10%. Once a strategy is approved for the garden, it will be executed by a Keeper. Currently, these Keepers are ran by the Babylon Finance team, but the plan is to eventually have these Keepers be automated decentralized smart contracts.

It is also important to note that strategies are limited in the actions they can employ. You don’t have to worry about your capital being used in some obscure DeFi fork with questionable liquidity. These are all the protocols that strategies can currently interact with:

Uniswap v3 for trades and price oracle

Uniswap v2 LP tokens

Compound lending and borrowing

Aave lending and borrowing

Sushiswap pools

Lido staking

Stakewise

Yearn vaults

Babylon Fuse Pool on Rari

Pickle Jars

Curve Pools

Convex Staking

Once a strategy is completed, strategy assets will be automatically converted back to the reserve asset of the Garden. If this is a bit confusing for you, here is a graphic outlining the process:

Profits and Fees

If your familiar with traditional finance, you would know about the standard ‘Two and Twenty’ fee structure. Babylon greatly reduces these fees by having a 0.5% management fee on capital deposits and a 5% fee on profits. Those fees get distributed to BABL holders, the token of Babylon Finance. More on this later! It is up to the creator of the Garden on how the other 95% of the profits get split up. While a creator cannot reap all the profits for themself, they could distribute slightly more of the profits to Strategists and Voters to encourage participation in the Garden.

One of the more interesting features of Babylon is its Gasless Deposits mechanism. As you probably already know, using Ethereum is expensive! The increased costs of using Ethereum can be especially prohibitive to smaller retail users. To counteract this, Babylon Finance allows you to deposit into Gardens for free when gwei is under 125! The gas fee will be subsidized by all members of the garden and Babylon’s treasury.

The last fees you must be mindful of when using Babylon are the early withdrawal fees. These fees only apply if two criteria are met:

A strategy is currently active

There is not enough liquidity in the Garden to meet withdrawal demands

If you still wanted to withdraw, you would have to pay a 2.5% fee. This fee will be used to compensate other members of the garden. Additionally, if you decide to withdraw early, you also forfeit any BABL rewards you would have otherwise recieved.

Statistics on Babylon Finance

To date, Babylon Finance has accumulated a protocol total value locked (TVL) of $21.86 million. The two most successful gardens to date are the verified “The Fountain of ETH” and “The Stable Garden” gardens. These two strategies have a TVL of $9.64 million and $4.66 million, respectively. For the Fountain of ETH, it is a Garden with an investment thesis of accumulating ETH through low-risk strategies and no price risk. The main strategy it is currently utilizing is leveraged 3x stETH, and the variable APR is 25.54% (0.91% from investments and 24.63% from BABL rewards). As for the Stable Garden, it is a Garden with an investment thesis of yield farming DAI with low-risk investments. This garden utilizes a variety of different strategies to generate profits and it currently has a variable APR of 26.26% (6.75% from investments and 19.51% from BABL rewards).

Babylon Finance has 94 active Gardens/Investment Clubs and 1508 users interacting with the protocol. While this numbers may not jump out at first, it is important to remember that Babylon Finance is still only in public beta and essentially brand new.

The BABL Token: Governance & Tokenomics

At the core of Babylon Finance is the BABL token. The purpose of BABL is twofold:

Serve as the governance token for Babylon Finance

Accrue value from fees generated by Babylon Finance

Governance

Nowadays, every dApp and protocol has a governance token. Babylon Finance is no different with BABL serving this role. By owning BABL, you share ownership over the Babylon protocol, have the ability to vote on various different proposals for the protocol, and can also submit proposals. Importantly, Babylon Finance is aiming to works towards progressive decentralization. Over time, the team will give up more and more control to the community as project matures and grows. Currently, the following things can be changed by governance:

Treasury Management

Protocol Fees

Rewards Programs

Integrations

System Upgrades

While Babylon does try to minimize the need for governance, much of the community does not participate in governance. For most proposals, less than 10 addresses typically vote with most of the voting power being controlled by team members. Before moving on, it is important to note that the team cannot unilaterally decide to implement changes to Babylon Finance without first going through a vote. You can check out all the Babylon Finance Proposals and votes here.

Tokenomics

At genesis, a total of 1,000,000 BABL was minted. This is also the max supply, unless BABL holders vote to implement an annual inflation rate which could increase the supply of BABL up to 5% per year starting after 8 years of existence for the protocol. Initial distributions of the minted BABL was:

The team’s 10% allocation is vested over a four-year period. As for the seed investors, their 19% allocation is vested over a three-year period. As for the reserved allocation, it has still yet to have been used for a second round of funding. Most importantly, the community has a sizeable allocation at 69% (nice). The community allocation of 690,000 BABL will be used in several different ways:

500,000 BABL is allocated to the BABL Mining Program

50,000 BABL is allocated for various liquidity events, such as The Prophets NFT IDO

140,000 BABL is allocated to the treasury to be controlled by governance and used to fund new initiatives

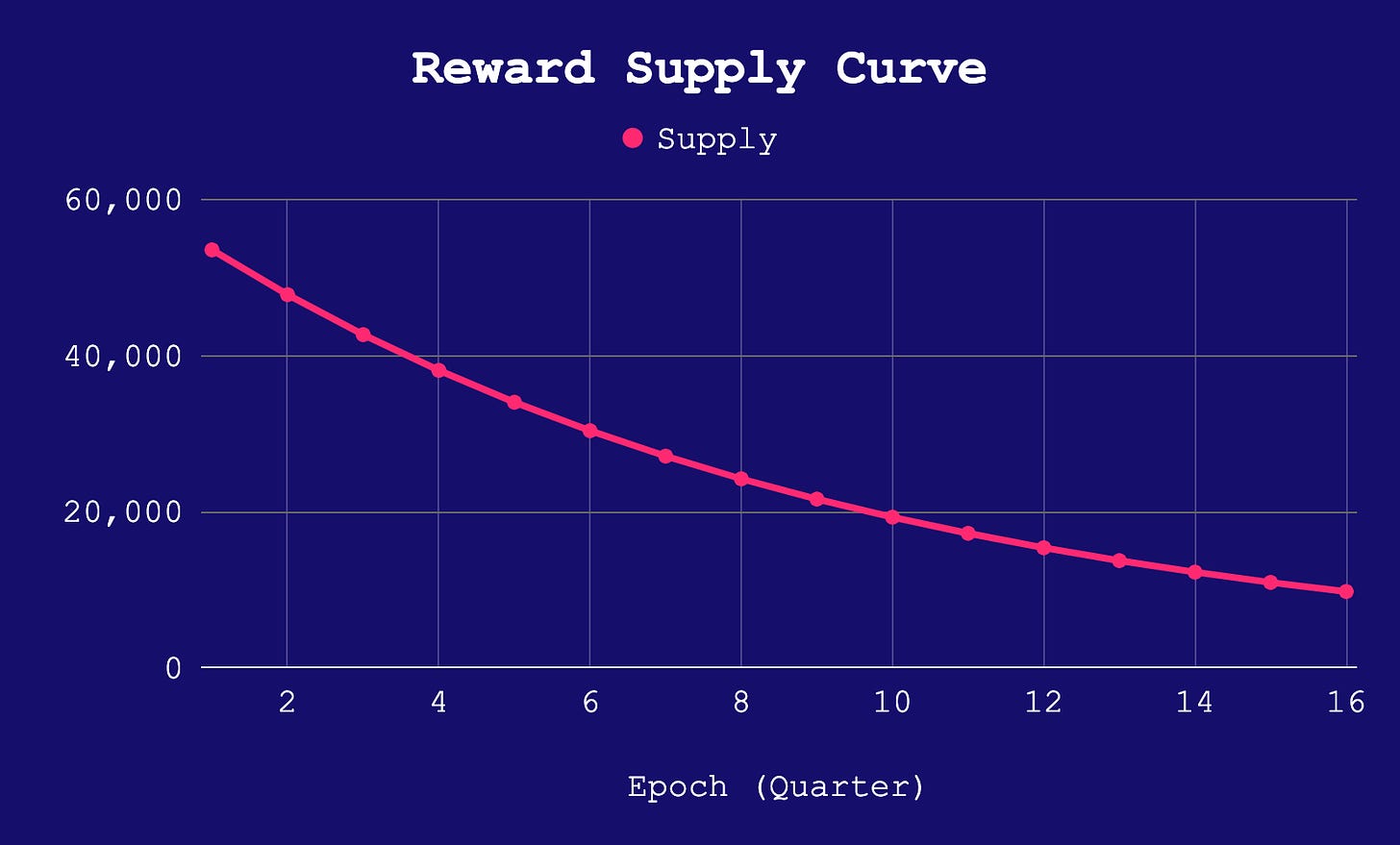

Of these three, the most important is the BABL Mining Program. The program is designed to allocate BABL to Gardens with successful Strategies and last for a period of 10 years. The BABL rewards are constantly decaying over time, so higher rewards are front-loaded. Here is a graph of the supply curve for the mining program:

Additionally, the BABL rewards a Garden receives is dependent on a variety of other factors including:

Length of the Strategy

Capital allocated to the Strategy

The success of the Strategy

Returns < -20% annualized = BABL rewards slashed by 85%

-20% Annualized < Returns < 4% annualized = BABL rewards slashed by 40%

Returns > 4% annualized = BABL rewards boosted by 15%

Lastly, how the BABL rewards get distributed within the Garden is also dependent on one’s role within the Garden. Here is a diagram of how different members of the Garden get rewarded:

So, if you want some BABL, you have to use Babylon Finance! This is a great way to both encourage the use of your protocol and have your token distributed to your actual community.

The Heart of Babylon

The last important part of the BABL token we must go over is its staking mechanic, The Heart of Babylon. The Heart (for short) is a Garden that was just recently introduced back in February and takes inspiration from a variety of different DeFi protocols including Curve, OlympusDAO, Tokemak, Sushi, etc.

To use this Garden, users must deposit BABL for a minimum of two months. In return, depositors receive hBABL, which is a vote-escrowed token similar to veCRV. hBABL holders will be able to vote on governance proposals gas free through signature voting. If your unfamiliar with veCRV and veTokenomics, feel free to check this post out which goes over those concepts (LINK). Remember those aforementioned .5% management fees and 5% performance fees? The value from those fees accrue to hBABL holders. Here’s how:

25% of fees will be used to increase BABL/ETH liquidity on Uniswap v3

30% of the fees will be used to buyback BABL. Of the bought back BABL, 50% will be going towards the Heart Garden while the remaining 50% will be locked into the treasury.

15% of the fees will be invested in other gardens to generate yield for hBABL holders

20% of the fees will be lent out in Babylon’s Fuse Pool on Rari

10% of the fees will be used to increase Protocol Controlled Value

All of the weights can be changed by hBABL holders through voting also. Additionally, 75% of the BABL deposited in the Heart will be lent out to Babylon’s Fuse Pool. The Heart will then borrow stables and use those stables to generate yield for hBABL holders. If you’re a bit confused, here is a graphic courtesy of Babylon Finance to help you out:

Lastly, users can also bond certain assets to receive discounted hBABL. To get a 5% discount on hBABL, users must bond BABL-ETH LP tokens. To get a 3% discount on hBABL, users must deposit DAI or FRAX on Babylon’s Fuse Pool and bond the LP tokens they receive.

Risks and Personal Thoughts

Risks

As with all things in DeFi, nothing comes without risk. Babylon Finance is no exception. Starting with smart contract & security risk, Babylon Finance takes a lot of measures to mitigate these risks. Based on their GitHub and Documents, they take security very seriously. Babylon Finance has had several audits done on some of their protocol architecture, with more expected along the way. The company Pessimistic has done their most recent audits. Additionally, Babylon Finance has a Bug Bounty Program. The highest payout is $100,000 for critical issues. While there will always be some level of smart contract and security risk, Babylon Finance does try their best to mitigate these risks.

Babylon Finance is also exposed to both market and yield risk. If the market tanks or yields in DeFi compress, both the BABL token and Gardens exposed to these risks will face negative consequences. On top of this, Babylon Finance is exposed to risks shared by the protocols it integrates with. Also, any Garden is suspect to bad management. There is no guarantee that a strategy will be profitable for a Garden. As such, it is imperative for users to carefully research which Gardens they deposit into and what strategies they employ.

Lastly, public Gardens are exposed to hostile takeovers. A whale with enough capital could garner over 50% of the voting power and force a Garden to do his bidding. However, as with all 51% attacks, this is a negative sum game for the user behind the hostile takeover. These risks can easily be mitigated by deposit maximums.

Personal Thoughts

By this point, you should have a pretty good understanding of Babylon Finance. If you want to learn more, I highly recommend you check out their Documentation and Medium. As for my own opinion on Babylon Finance, I really like the concept and vision behind it. There is certainly a need for decentralized asset management, and Babylon Finance has the potential to fulfill this market. Its core product, Gardens, seems to be extremely unique innovation that I think will be successful long term.

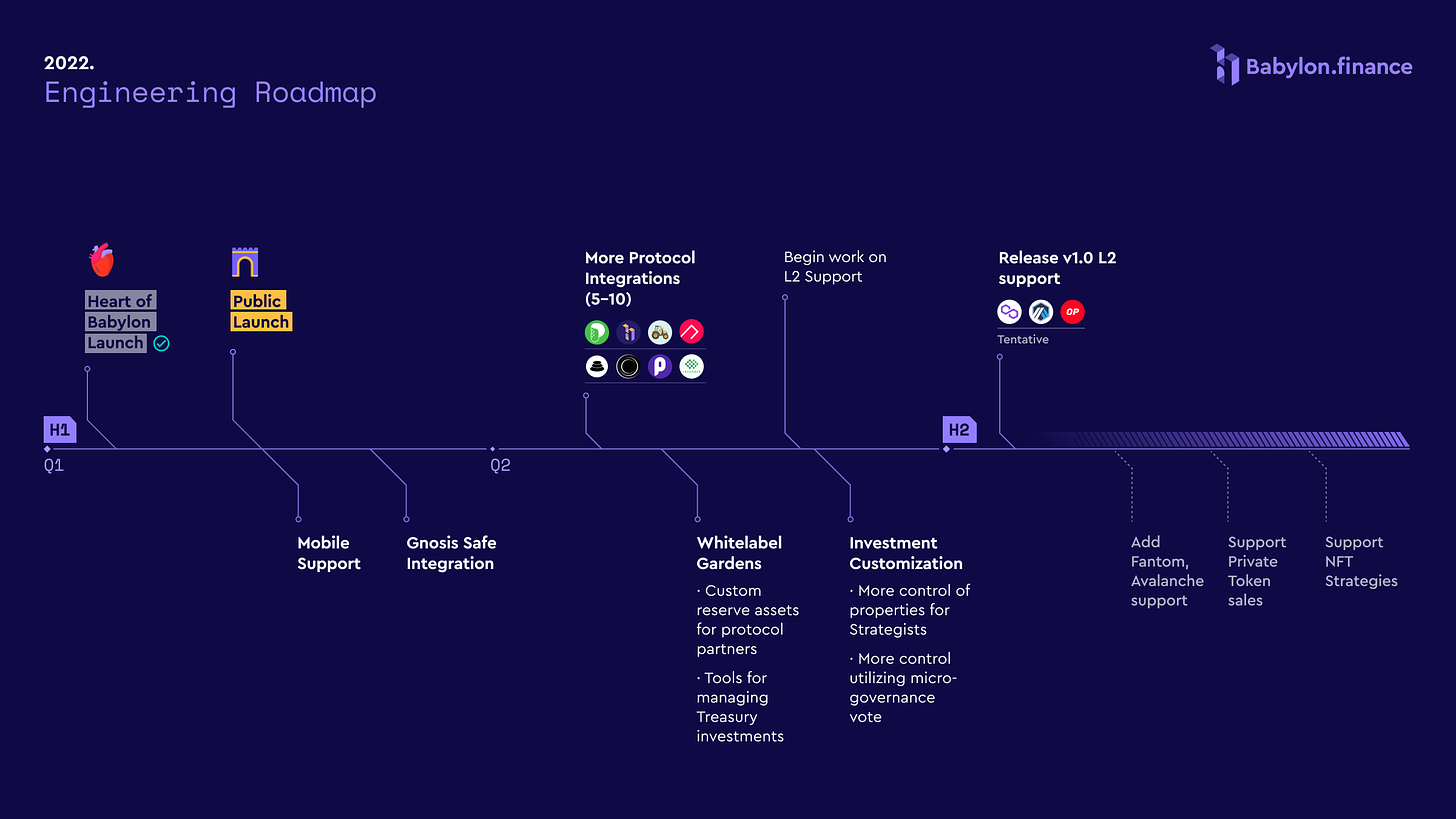

There are a few things Babylon Finance could improve upon. First and foremost, Babylon Finance needs to expand on to other chains. Many of the highest yielding DeFi strategies no longer exist on Ethereum and instead are on alternative Layer 1’s or Layer 2’s. Gardens should be able to execute strategies that involve cross-chain applications. Babylon Finance does have plans to go cross-chain, but I personally think this should be one of the top priorities. This functionality will allow Gardens to achieve higher yields and attract more users.

My other suggestion for improvement would be to try and become more retail friendly. I think Babylon can really capture a large portion of the previously mentioned ‘Social Investing’ money by doing this. Some measures could include a Fiat On-Ramp and an interface that could be used by non-crypto natives. Other than that, Babylon’s roadmap seems to be on the right track, and I will be closely monitoring their progress.

As for investing in BABL, I think the best way to do that right now is by simply joining Gardens. Personally, I plan on allocating some DAI to The Stable Garden in order to accumulate BABL. I prefer this to outright buying BABL as it still has a pretty low circulating supply. Liquid supply is ~311K, which means that only ~31% of the supply is circulating. However, the fully distributed value is only ~$38.58 million, so there is definitely large upside potential.

If you want to try out Babylon Finance for yourself, feel free to use my referral code:

Conclusion

That’s all we got for this post! I hope you enjoyed this overview and analysis on Babylon Finance. Also, I just want to give a quick shoutout to Ramon Recuero, the founder of Babylon Finance, for the opportunity and the help! Go give him a follow on Twitter!

A lot of work, research, and effort went into the making of this. If you found it helpful and would like to donate, you can do so at our Ethereum Address:

0x7ba9aa5E4caD26EA5E8ba4AC286E5d38Af91F62b

All the content we put out is free, so your donations are greatly appreciated!

Thank you for taking the time out of your day to give this post a read. Your support really means so much to us! If you enjoyed this post, please help us spread it around by giving it a share! If you want more content like this, why not subscribe? You won’t regret it! If you have comments, questions, or concerns, please feel free to either comment them or hit us up on Twitter. Once again, thank you and we hope you enjoyed!