Friday Newsletter #2: Fake News… in Crypto?

Learn about the big headlines this week and an overview of the price action

Introduction

Hello all and welcome to the second edition of the Friday Newsletter! It was a slower week than last week, partly in thanks to no flash crashes… Thank God. But there were definitely some news worthy headlines you have to check out!

You will learn about the Walmart-Litecoin fake news debacle, Solana temporarily shutting down, and AMC accepting cryptos for payment. Additionally, there will be an overview of this past week’s price action. Before we jump into it, we just want to let you know that your feedback is greatly appreciated. Don’t be afraid to comment!

Weekly News: 3 Big Things

The Fake Partnership Between Litecoin and Walmart

At 8:50 AM on Monday, September 13th, Litecoin’s official Twitter sent out this tweet:

The markets reacted quickly and sent Litecoin from roughly $175 to $235 in a span of minutes. Major news outlets such as Reuters and CNBC quickly sent out headlines, essentially verifying the news. However, it was all fake. There was no partnership between Litecoin and Walmart.

Walmart quickly put out a press release that said is “has no relationship with Litecoin.” After that, Litecoin’s price quickly tumbled back to where it was before the “news” broke out.

The fake news originated with Globenewswire, a newswire distribution company. They blamed the fake press release on a “fraudulent user account” and issued a notice to disregard. However, the damage was already done by that point. Although in the grand scheme of things this fake news incident will have no long term impact on the crypto markets, there are two important takeaways.

Firstly, crypto markets move fast. In the span of just minutes, Litecoin shot up ~35%, no small feat. And once the news was confirmed as fake, Litecoin’s price fell off a cliff just as quickly. As a crypto investor, you too have to be fast. This market operates 24/7 and is global. Pretty much anything can happen at anytime, and you have to be prepared for that. This isn’t the stock market where everything shuts down on weekends, holidays, and in the middle of the night. No, this is something completely different.

Secondly, don’t trust anything you see out there on the internet, no matter how real it seems. Always verify your information, it may save you one day. Also, ask yourself if the information even makes sense. Take a step back, does it really make any sense for Walmart to partner with Litecoin? Why would Walmart choose Litecoin over other cryptos such as Bitcoin, Ethereum, and forgive us for saying this, or even Doge? You know, cryptos people actually have heard about. Litecoin is pretty much a Bitcoin ripoff, even the founder of Litecoin doesn’t even hold Litecoin (LINK). Sorry to all of those who are invested in Litecoin, maybe one day Walmart will actually partner with Litecoin (They won’t).

Before you move on to the next article, just take a moment to appreciate how ridiculous Litecoin’s one week chart is.

Solana Temporarily Shuts Down

On Tuesday, September 14th, popular Layer-1 (L1) blockchain Solana temporarily stopped producing blocks, effectively shutting down the network. Basically, for almost a day, no transactions could be sent on the Solana blockchain. Before we get further into this, let’s go over what Solana is.

Solana is an L1 blockchain with smart contracts operability. It is a direct competitor to Ethereum. Like Ethereum, it is a computing platform where various dApps can be built on top and inherit the security of the blockchain. An example of this is how AAVE (The most popular decentralized lending platform) is built on the Ethereum blockchain. Similarly, other cryptos can be deployed on the Solana blockchain.

A problem with Ethereum, however, is that it has difficulty scaling. What that means is that when demand for Ethereum is high, transaction costs become very costly. It is not unheard of for it to cost well over $20 to send Ethereum from wallet to another. Solana’s value proposition is that it is scalable. Solana claims that it can process 50,000 transactions per second (TPS). Becuase of the high TPS, fees are typically a fraction of a cent. Ethereum, on the other hand, currently handles ~30 transactions per second.

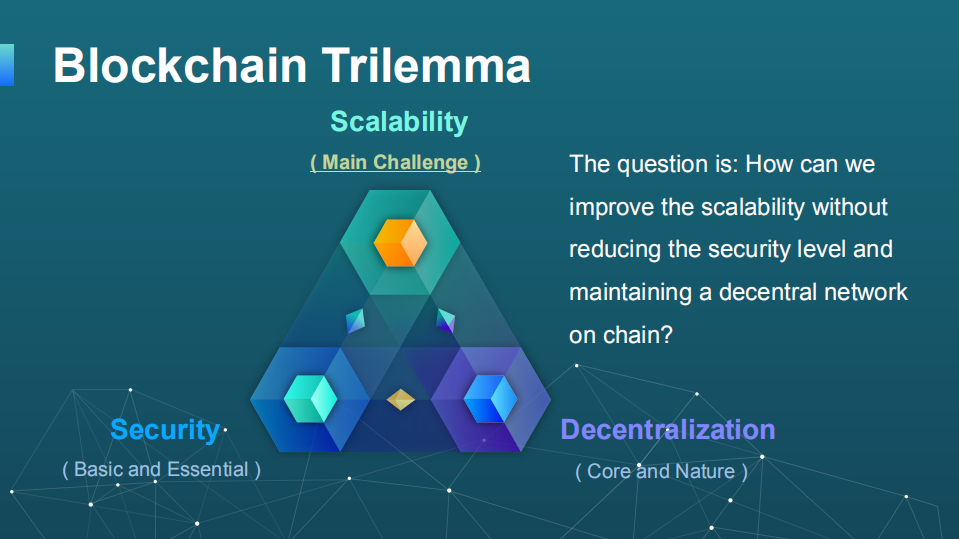

However, Solana’s incredibly high TPS does come at a cost. This is the blockchain trilemma.

With our current technological means, it is very hard to increase on scaling without sacrificing on security or decentralization. Security is not something blockchains are willing to compromise on, as no one would put their money in a blockchain that can be easily hacked. That means giving up on decentralization for blockchains who wish to increase their output. We saw this in action this past week with Solana.

When a DoS attack hit the Solana blockchain, transactions spiked to 400,000 TPS. Not being equipped to handle this level of output, the Solana blockchain began to fork. Essentially, validators could not decide on what block was the “right” one. Faced with all of this, Solana was shut down for maintenance by the team, proving it is not decentralized as other chains such as Ethereum.

Solana is up and running now, but this whole debacle shows the importance of decentralization. It is a core tenet of cryptocurrency and blockchains, and without it, blockchains are nothing but glorified databases.

AMC to Accept Cryptocurrencies for Payment

Retail investor fan-favorite announced this past week that they will accept several cryptocurrencies as payment at their movie theatres. CEO Adam Aron tweeted:

As the tweet states, the cryptos they will be accepting are Bitcoin, Ethereum, Litecoin, and Bitcoin Cash. This is another positive development in the push for real world adoption of cryptocurrencies. Here is a list of just some of the companies that currently accept crypto as payment:

Pavilion Hotel & Resorts

AXA Insurance

Microsoft

Starbucks

Visa

PayPal

airBaltic

Sotheby’s

Expedia

AMC

That is just a small sample of companies, for reference, but everyday more and more companies are accepting crypto.

For AMC, the push to adopt cryptos makes sense. AMC stock witnessed a massive increase in its stock price this past year, going from lows of $1.91 to highs of $72.62. This massive increase was fueled by a retail investor craze for meme stocks. Being that retail investors are also interested in cryptocurrencies, it makes sense for AMC to cater to their “new investors” and accept cryptocurrencies.

In terms of price pressure for Bitcoin, Ethereum, Litecoin, and Bitcoin Cash, the AMC news shouldn’t really drive up the price. However, as more and more companies begin adopting crypto, that will drive up the price. Great news for crypto!

Price Action

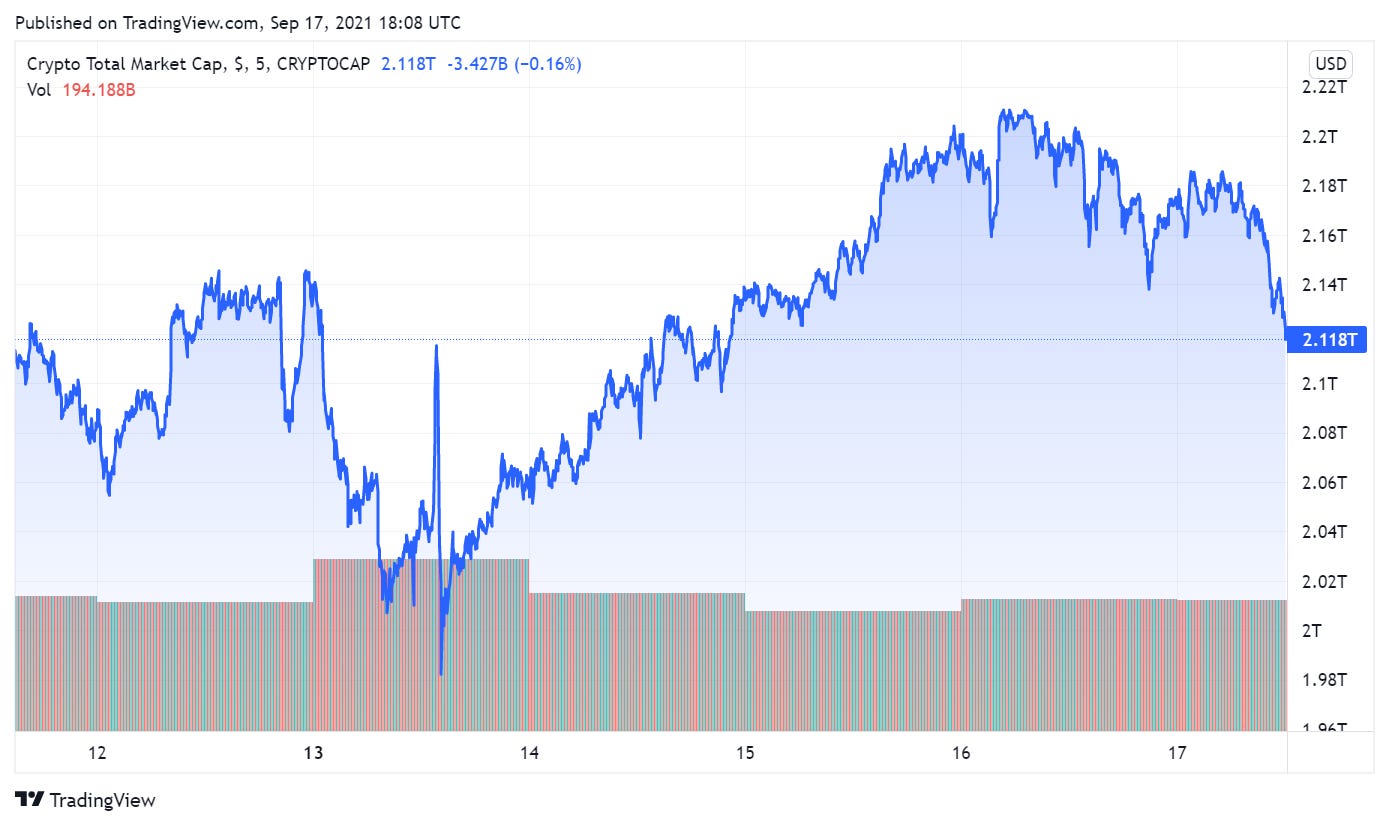

This will be the first edition where we have a more traditional overview of price action. We will start with a look at the total crypto market, and then follow it up with the price action for the top 10 non-stablecoin cryptos. Afterwards, we’ll pick 3 winners and 3 losers for the week outside of the top 10. Prices will be marked from last Friday at 12:00 PM to this Friday at 12:00 PM for uniformity. Price info is from CoinGecko, CoinMarketCap, TradingView and Coinbase.

Total Market

Last Friday, the total crypto market cap was just about $2.05 trillion. Around 12:00 PM today, the total market cap was about $2.13 trillion, giving a weekly return of a modest 3.9%. Although the market ran as high $2.2 trillion, we are still not at levels we saw before the flash crash. However, a good week for crypto all things considered.

Top 10

1) Bitcoin (BTC)

Open: $45,428.40 | Close: $47,526.82 | Return: 4.62%

A great week for Bitcoin as it outpaced the market with it’s 4.62% returns

Unsurprisingly, it remains it’s position as the King.

2) Ethereum (ETH)

Open: $3,299.17 | Close: $3,451.97 | Return: 4.63%

Oddly, Ethereum almost posted identical returns to Bitcoin this week. Ethereum looked poise to make a breakout on Thursday, reaching highs of $3,675.92, but stumbled with the rest of the market on Friday morning.

3) Cardano (ADA)

Open: $2.39 | Close: $2.44 | Return: 2.09%

A quiet week for Cardano after being one of the best performers during August. It’s launch of smart contracts this week didn’t seem to have too much affect on the price.

4) Binance Coin (BNB)

Open: $405.45 | Close: $411.97 | Return: 1.6%

An essentially flat week for Binance Coin as it underperformed the market. Fears over regulatory concerns are keeping the price pressure down.

5) Ripple (XRP)

Open: $1.07 | Close: $1.07 | Return: 0.00%

A flat week for XRP. Nothing really to note here as it’s legal battle with the SEC is ongoing.

6) Solana (SOL)

Open: $179.60 | Close: $144.73 | Return: -19.42%

A brutal week for Solana as it’s network shutdown had a steep negative impact on its price. However, it is still up well over 100% in the past month.

7) Polkadot (DOT)

Open: $29.54 | Close: $33.97 | Return: 15.00%

A great week for Polkadot as it outperformed the market by more than 3x. Keep an eye out for this coin as it may just be getting started.

8) Dogecoin (DOGE)

Open: $0.24 | Close: $0.24 | Return: 0.00%

Sigh. Why is this coin still in the top 10?

9) Avalanche (AVAX)

Open: $48.01 | Close: $64.18 | Return: 33.68%

An absolutely massive week for Avalanche as it has finally breached the top 10. This coin was easily the best performer in the top ten for this week.

10) Terra (LUNA)

Open: $41.55 | Close: $35.04 | Return: -15.67%

A tough week for Terra as it corrected from it’s all time high’s past week. Hopefully this won’t be a prolonged downward trend.

Winners & Losers

Winner: Curve (CRV)

Open: $2.18 | Close: $3.00 | Return: 37.61%

An awesome week for Curve as it’s finally getting the recognition it deserves. This is a top tier DeFi cryptocurrency and should be valued as such.

Loser: FTX Token (FTT)

Open: $73.54 | Close: $63.82 | Return: -13.22%

A rough week for FTX’s exchange token as it dropped double digits in % points. However, you shouldn’t read too much into it as it is coming off all time highs.

Winner: Cosmos (ATOM)

Open: $26.36 | Close: $34.06 | Return: 29.21%

Cosmos finally joins in on the L1 blockchain fun and posts an extremely strong week. Layer 1 blockchains have been the hot sector these past couple weeks, will it continue?

Loser: Fantom (FTM)

Open: $1.50 | Close: $1.29 | Return: -14.00%

Similarly to FTT, Fantom experienced a down week after hitting all time highs. Keep an eye on this coin, however.

Winner: Gala (GALA)

Open: $0.02 | Close: $0.09 | Return: 350%

This coin came out of nowhere to propel itself into the top 150 cryptos on the back of a 350% performance. Admittedly, we do not know much about this coin, but will be watching it closely to see if it is legit or just a pump and dump.

Loser: Amp (AMP)

Open: $0.0524 | Close: $0.0485 | Return: -7.44%

Another down week for Amp as it continues it slide after it’s epic Coinbase listing pump in June. If you bought the top in June, you may be a bit worried by now.

Conclusion & Pick our Next Post!

Before we sign off, we just want to let you know what our plans are for our next post. On Tuesday, we will be doing a deep dive into a crypto of your choice! You can let us know which coin you want done by either commenting here or tweeting as us on Twitter. On Sunday, we will put up a poll of the most requested coins on Twitter. The winner of the poll will be the coin we choose to do a deep dive on!

We hope you enjoyed this week’s edition of The Average Joe’s Crypto Friday Newsletter! Questions? Concerns? Feedback? Please let us know by commenting here or through Twitter. We’re more than happy to respond! Have a great weekend everyone!

Disclaimer: None of this should be taken as financial advice. It is for entertainment purposes only.

I am enjoying the articles. Good job.

Can you do a deep dive on ravencoin?