Friday Newsletter #1: Chaos on Bitcoin Day!

News, events, and price action for the week of September 4th to September 10th. Enjoy!

Introduction

Hi all and welcome to the first edition of The Average Joe’s Crypto Friday Newsletter! A HUGE week for crypto as there was no shortage of headlines. Bitcoin is now legal tender in El Salvador, the SEC opened an investigation into Uniswap, and the SEC plans on suing Coinbase. Additionally, we will go over this week’s flash crash and discuss some key differences between investing and gambling in crypto. Let’s get right into it!

Weekly News: 3 Big Things!

El Salvador Adopts Bitcoin as Legal Tender

On September 7th, the Bitcoin Law officially took effect in El Salvador. The law is quite simple, actually. Basically, as the header says, Bitcoin is now legal tender in El Salvador. What this means is that Bitcoin can now be used to purchased all goods and services in El Salvador. Similarly to how you use dollars to purchase a sandwich or get a haircut, people in El Salvador can now use Bitcoin instead. However, Bitcoin is not replacing the current currency that is used in El Salvador, which is US dollars. Rather, both Bitcoin and US dollars will co-exist and both be accepted as legal tender. For those in El Salvador who are skeptical of Bitcoin, they do not have to hold Bitcoin and can choose to convert any Bitcoin they receive into US dollars at any time.

Hopefully, you now have a general understanding of what the Bitcoin Law does. We could probably spend an entire day writing about the implications this will have on the crypto market, but we’re gonna try to keep it short and simple.

Firstly, this will only have a small and limited impact on Bitcoin prices in the short term. El Salvador is a small country with a small GDP (~$25 Billion). For reference, that is about 2.87% of Bitcoin’s ~$870 billion market cap. By just looking at the numbers, we can see that El Salvador won’t be the driver behind any short term gains. However, El Salvador is purchasing Bitcoin. According to their president, they have bought and now hold 550 Bitcoin (Tweet). Every little bit counts!

However, and we can’t overstate this enough, Bitcoin becoming the currency in a legitimate country is perhaps the most important event in its existence. Yes, we really mean it. Why? Let us explain. Firstly, Bitcoin is now legitimized. It is no longer just some “internet money that has no real use case.” It is the national currency of a country.

Secondly, let’s take a look at the game theory now in play. If you’re a neighboring country of El Salvador, what do you do now? If your economy is heavily intertwined with El Salvador’s, what do you do? That’s right, you’re probably gonna consider this whole Bitcoin thing. And then when other countries around you start adopting Bitcoin, are you gonna also adopt Bitcoin? Most likely. Don’t believe us that this is happening? Here’s a list of countries who have either already introduced legislation or plan on introducing legislation to make Bitcoin legal:

It’s a small list, but it is happening. Remember, there are only 21 million Bitcoins that can exist. Millions of them are already gone forever in lost wallets and old hard drives. When countries start buying Bitcoin to put in their reserves, that is when the mania starts. It’s a domino effect, once everyone around you starts buying Bitcoin, you better join in before it is too late.

SEC Begins Investigation into Uniswap Labs

Last Friday, news broke out that the SEC was launching an investigation into Uniswap Labs, the developer group behind the cryptocurrency Uniswap. Don’t worry, we know what you’re thinking right now: What the hell is Uniswap? Well, let’s answer that question.

What is Uniswap? Uniswap is currently the largest decentralized exchange (DEX) in crypto. Well that didn’t answer the question…What’s a decentralized exchange (DEX)? A decentralized exchange, a core aspect of decentralized finance (DeFi), is best understood in comparison to it’s opposite: a centralized exchange (CEX). A centralized exchange is a company or app such as Coinbase, Binance, Kraken, Gemini, etc. that acts as the third party in cryptocurrency transactions. What makes these exchanges centralized is that they essentially work as middlemen. Buyers and sellers of crypto interact with these third parties to facilitate transactions. The problem with centralized exchanges? There’s tons. Here’s a short list:

They charge a fee for facilitating your purchase or sale

Must trust the CEX to hold your crypto and not lose it (Look up Mt. Gox Hack!)

CEXs are not permissionless: they can choose who can or cannot use their platform

Know-Your-Client (KYC): They have to verify who you are before you can trade

As in the case of Coinbase, they can only provide services on select cryptocurrencies due to regulatory pressure

What if there was a way to trade cryptos without the cumbersome middlemen central exchanges? This is where decentralized exchanges such as Uniswap come in. Decentralized exchanges make it so that buyers and sellers can interact with each other without a third party facilitating transactions. How do they do this? Well, it’s complex. Through the use of smart contracts and liquidity pools, platforms such as Uniswap enable trustless and permissionless crypto trading. To interact with the Uniswap platform, all you need is a wallet (Metamask for example) and some crypto assets in it. Once there, you can exchange pretty much swap for any crypto you want without worrying about a third party taking your funds or denying you access.

To better understand DEXs and how they work, I highly recommend checking out Gemini’s article on them. Here’s the link. Additionally, here’s a diagram we put together for those who are more visual learners.

Now that you have some general understanding of what Uniswap is, lets get back to the issue at hand: What is the investigation about? As of right now, I wouldn’t worry too much about this. There have been no allegations of wrongdoing by Uniswap Labs. (Quick sidenote: Uniswap Labs created Uniswap, but they do not control Uniswap. Control over Uniswap comes from ownership of the Uniswap cryptocurrency token.) Getting back to the issue at hand, the SEC seems to just be collecting information on how Uniswap and other DEXs work and operate. Could legal action come from this? It’s certainly possible, but it is not guaranteed to happen.

We will end with this however, regulating Uniswap, DEXs, and other DeFi protocols is going to be a nightmare for the SEC. None of these creations fit into existing legal frameworks and will certainly take awhile to figure out.

SEC Plans on Suing Coinbase

Ah, yes. The SEC was busy this week. If the Uniswap news wasn’t enough, the SEC also plans on suing Coinbase over their planned Coinbase Lend product. On Tuesday night, Coinbase put out a statement that the SEC will go ahead with their intended legal action despite multiple attempts by Coinbase to work with legislators. Because of this, Coinbase Lend will not launch atleast until October.

Let’s start with this: The SEC is not suing Coinbase over it’s core business. OK, you can relax now. Although the crypto markets reacted slightly negatively to this when news first dropped, this should not have any long term price impact on the crypto market. Coinbase is just fine with their core business of being the third party in crypto transactions.

The problem arises with Coinbase Lend, a product that hasn’t even launched yet. Coinbase wants to operate as a crypto bank. Just as you deposit money into your savings account at your bank and earn interest on it, Coinbase wants you to lend them your crypto assets in return for interest payments. Why would you partake in this? Because the returns are much, much higher. As of writing, the average savings interest rate in America is 0.06%. Coinbase Lend will offer 4% interest on USDC, a stablecoin which will always be worth $1. That is 65 times higher… now you can see why crypto is so appealing.

So the question is now why does the SEC care? The problem is how we define this lend program. Is it a security? Or is it something else? The SEC is arguing that it is a security. Why? Because that means they get to regulate it and have some control over it. Coinbase is arguing that it is not a security. Why? Because that means the SEC cannot regulate the lend program. What we have on our hands is a legal battle that will probably not resolve soon. For now, just keep an eye on this story as it is an important one.

Flash Crash: What Happened?

This section is going to take on a different twist this week. In future editions, you can expect a more broad discussion on the markets and what happened over the week for a variety of different cryptocurrencies. However, we feel is it necessary to have an in-depth look at the Bitcoin flash crash that happened on Tuesday.

Bitcoin Price at 9:30 AM EST on September 7th: $51,063.95

Bitcoin Price at 11:00 AM EST on September 7th: $42,830.77

What happened? Well, the first question we need to ask is who or or what caused this crash. This is also the hardest question to answer. The short answer? We don’t know. The ~16% drop in Bitcoin’s price coincided with the entire crypto market losing roughly $400 billion. To cause a drop that drastic, you need institutional money in the market. So we don’t know exactly which institution (hedge fund, venture capital fund, bank, etc.), but we know institutional money did cause this just based on the sheer size of the move.

There are two things we want to focus on now: 1) Why was the crash so drastic, but so quick? 2) Why did the rest of the crypto market crash with Bitcoin? Let’s start with #1

Have you ever heard of leverage? If not, allow us to explain. Put simply, leverage is borrowing money to increase your position size. Let’s walk through an example. Let’s say there is some crypto that is trading at $5 a coin. With no leverage, you buy one coin and then let’s say a week later the coin goes up to $10 a coin. Congrats! You just made 100% returns! Now let’s put leverage into the example. Let’s say instead of buying one coin, you borrow an additional $5 (Bringing your total position to $10) and buy two coins. One week later the price goes up to $10 and you’re in profit, but how much? Rather than just making 100% returns, you’ve now made 200% returns! Trading with leverage increases your gains, but it also increases your losses if the crypto was to go down in value.

Last caveat with leverage, if the price moves against you too much, the person or entity you borrow from may force you to close your position. Why? Because they’re not giving you their money for free! They’re looking to make a profit off you! This is called liquidation.

Leverage is what caused the crash to be so drastic on Tuesday. Essentially, a whole bunch of retail traders and investors over-extended themselves. They borrowed too much money and over leveraged their position. When the price started moving downwards, they started to get liquidated. Liquidation = More selling pressure. As you can see, this is a snow ball affect. The more people that get liquidated, the lower the price goes, forcing more people to get liquidated, and so on. Take a look at how many people got liquidated during the crash:

Let’s move on to the second point. Bitcoin is King. At the end of the day, the crypto market and alt coins are going to follow what Bitcoin does. If Bitcoin is green on the day, you can expect the entire crypto market (on average) to also be green. And vice versa, if Bitcoin is red on the day, you can expect the market to also be red. This flash crash is a great example of this.

Take Chainlink for example. It crashed from $35 to $25 the same time Bitcoin crashed. Why? Because cryptos trade in conjunction with Bitcoin, especially on days where Bitcoin experiences significant losses. So whenever you go to buy or sell an alt coin, just keep that little fact in your head. Even if you don’t own any Bitcoin (bad idea), you have to pay attention to Bitcoin.

Investing vs. Gambling: What’s the Difference?

In our latest section, we want to talk a little bit about the difference between investing and gambling. One common critique of crypto is that those who participate in it are essentially gambling. This view, however, is wrong. Certainly, people can and do gamble in the crypto markets, but we here at The Average Joe’s Crypto believe that there is a way to avoid being a gambler and become a successful crypto investor. We want to share 3 simple tips that every successful investor should employ.

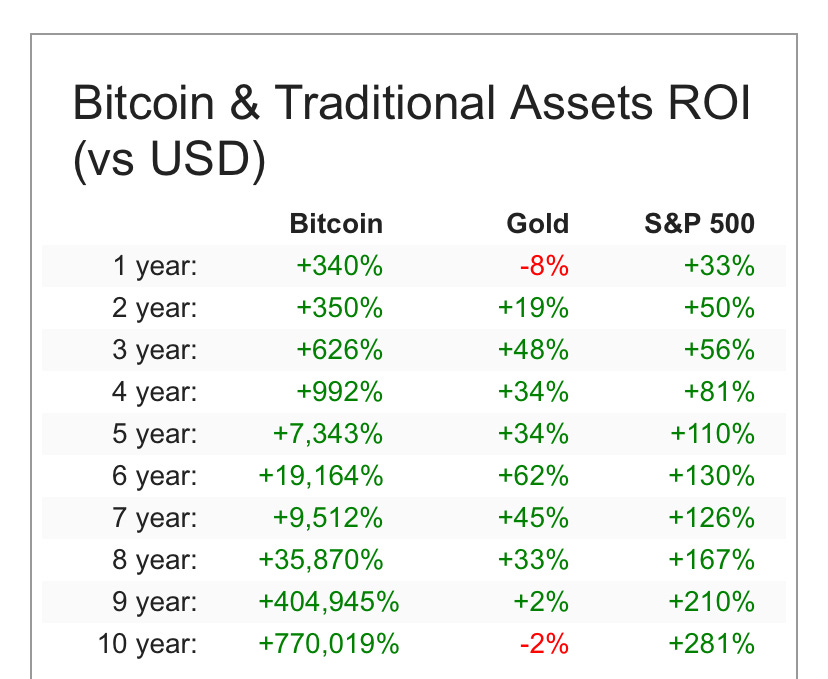

Number 1: Time. The first key to investing is time. Compared to the stock market, crypto is extremely volatile. However, take a look at Bitcoin performance compared to the S&P 500 (Stock market proxy) and gold:

As you can see, the longer you hold, the more handsomely you are rewarded. Even those who bought at the peak of the 2017 cycle (and held) are up well over 100%. The key to beating volatility is time. So when drastic drops happen, such as this past weekend for example, it may not be a bad idea to just hold.

As a general rule of thumb, whenever we invest in a new crypto project, our investment horizon is 5 years. That means we are comfortable holding the asset for five years, no matter the price action. Now this doesn’t mean you can’t take profits and sell a little bit if it appreciates greatly. In fact, we encourage it. But it means we plan on holding the majority of the asset for at least 5 years.

When investing in crypto, expand your time horizon!

Number 2: Money Management. Remember that whole section about leverage? Oh yeah, we forgot this part. DO NOT EVER USE LEVERAGE WHEN BUYING CRYPTO. Incase that wasn’t clear, allow us to say it one more time: DO NOT EVER BORROW MONEY TO BUY CRYPTO. Understood?

There are certainly some people who can successfully use leverage to maximize their gains, but guess what? You are not one of them. Avoid leverage at all costs, and do not use borrowed money to buy crypto. It’s a horrible idea and will most likely result in you losing all your money.

Building off that, do not invest more than what you are comfortable losing. If you have vital expenses you need to pay (rent, groceries, loans, taxes, etc.), pay those first! Crypto is volatile, it isn’t impossible for your investment to lose more than 50% of it’s value in a short period time. If you have extra cash lying around, use that money to invest in crypto, not money you may need in 6 months.

Number 3: Altcoin Investing. Don’t get us wrong, we invest in altcoins and do enjoy it. However, investing in altcoins is where the gray area of investing vs. gambling comes into play. We’ll talk more about finding good altcoins to invest in later editions, but for now, we want to remind you that altcoins should not make up a significant % of you portfolio.

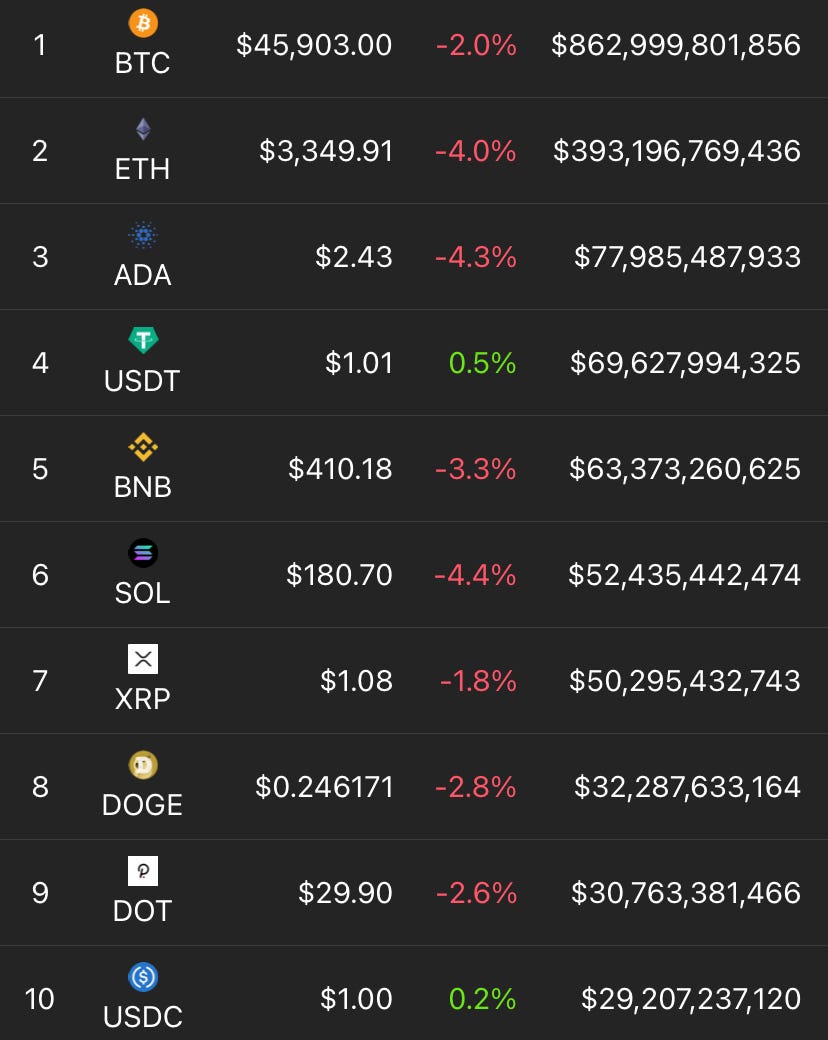

Bitcoin and Ethereum should make up the majority of your portfolio. If less than 50% of your portfolio is in these two coins, you are gambling. If you thought Bitcoin is volatile, then we got news for you: altcoins are a hell of a lot more volatile. The higher volatility will result in higher returns if you pick the right altcoins, but greater than 90% of altcoins will be worthless in a few years. Don’t believe us? Take a look at this:

Those were the top 10 cryptos on January 1st, 2017. How many are still in the top 10? Only Three.

Bitcoin, Ethereum, and Ripple. We don’t recommend investing in Ripple as it is a centralized coin, but you get the point. Alt coins will come and go, but you can rest assured that Bitcoin and Ethereum will still be on top.

Concluding Remarks & Update for Future Editions

Yes, we know. This post was long. It was longer than we wanted it to be, but we feel everything we talked about was important. To try and cut down on length and make it easier for you, the Friday newsletter will be split up into two different posts.

What will remain of the Friday newsletter is the headlines and price action. The last section, the wildcard section, will become its own post that will be released separately on Tuesdays. We feel this will make the Friday newsletter more digestible, AND allow us to go more in depth with the topics we want to cover.

Not immediately, but in the future, the Tuesday post will only be available for paid subscribers. It will not be going paid immediately because we feel that you guys should see the product before paying for it. Pricing information will come later, but we wanted to give you guys the heads up on the direction we are going in.

Well, that’s all we got for today. We hope you guys enjoyed this week’s edition of The Average Joe’s Crypto! Questions? Feel free to leave a comment or shoot us a Tweet. We’re more than happy to answer any questions you have. Have a great week everyone!

Disclaimer: None of this should be deemed financial advice and is purely for entertainment purposes only.