Arbitrum: A Deep Dive into the Layer 2 Scaling Solution and its Fascinating Ecosystem

An overview of Arbitrum and a look into one of the fastest growing ecosystems in all of crypto

Introduction

As of late, crypto has been dominated by a lot of fear and uncertainty. Macro fears such as the war between Russia and Ukraine, future rate hikes, and rampant inflation have driven the market back from the all-time highs it reached in November. As such, a lot of the focus has been taken off of crypto specifically and has been placed on to these other larger macro events instead. We won’t lie, the macro is concerning. But for the purposes of this article, let’s forget about all those unnerving events that are happening and instead focus our attention on what is happening in crypto.

Whether we are entering a full-on bear market or not, one thing is clear: Crypto is not going anywhere. Sure, prices could continue to decline, but they will eventually rebound. Too much innovation and activity are occurring for it not to. No matter what, builders, developers, and innovators will continue to push the boundaries and continue to grow this new asset class. One development we’ve been tracking closely and are extremely excited about is Arbitrum! The Ethereum Layer 2 scaling solution has shown us a glimpse of the future, with its low fees and vibrant ecosystem. Not sure what we’re talking about? Keep on reading then to learn all about Arbitrum and what it has to offer!

Welcome to the Average Joe’s Crypto and we hope you enjoy our overview and analysis on Arbitrum. If you do, please feel free to give this post a share as it is greatly appreciated!

If you really enjoyed this post and don’t want to miss any future analyses, breakdowns, or overviews we do, make sure to subscribe!

Let’s get right into it!

What is Arbitrum?

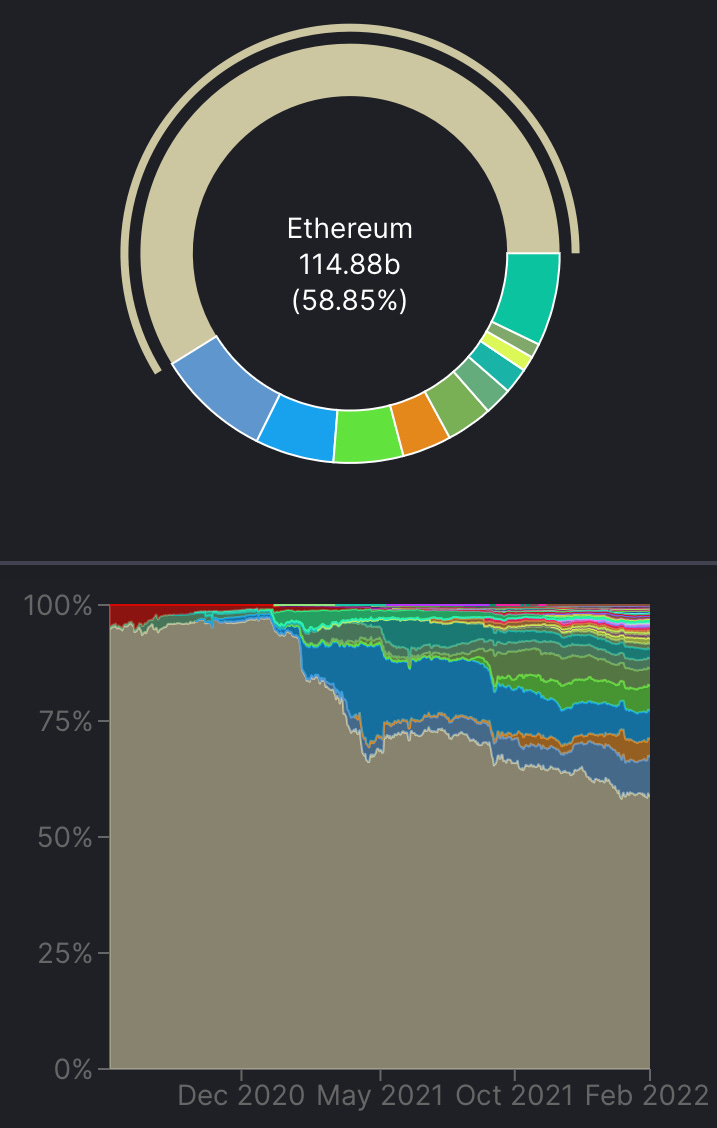

When you think of Ethereum, we’re sure one of the first things that comes to your mind is its fees. For all the great things Ethereum does, its biggest downside is easily it’s high fees. While fees are not themselves inherently bad, high fees can become especially prohibitive to smaller retail users. In fact, Ethereum’s high fees was one of the main reasons why 2021 saw an explosion in growth of alternative Layer 1 platforms. On January 1st, 2021, just under 97% of all DeFi Total Value Locked (TVL) resided on Ethereum. Today, Ethereum’s dominance is down to under 60%.

Obviously, Ethereum is still the premier Layer 1 smart contracts platform, but there is huge demand for cheaper alternatives. Alternative Layer 1s such as Solana, BSC, Avalanche, Fantom, etc. may be cheaper to use than Ethereum, but they each have their own individual drawbacks when it comes to security, liquidity, and decentralization. Now, what if there was a way to interact with Ethereum without paying ludicrously high fees? Enter Arbitrum.

Arbitrum is an optimistic rollup Layer 2 scaling solution for Ethereum. If you’re unfamiliar with crypto, that just probably sounded like a bunch of gibberish to you. We’re going to try and avoid getting super technical and try to make this easier to understand on a superficial level. Let’s try and break it down.

Basically, you can think of a Layer 2 scaling solution as a blockchain built on top of another blockchain. In this case, Arbitrum is built on top of Ethereum. By building on top of Ethereum, Arbitrum enables cheaper & faster transactions to occur while benefiting from the security of Ethereum. This is a huge advantage over sidechains or alternative Layer 1s. A perfect example of this is the recent wormhole hack on Solana. When you bridge Ethereum-native assets cross chain to a different Layer 1, you are at risk of bridge exploits or hacks. However, when you bridge Ethereum-native assets to Arbitrum, no such risks exist. Rest assured, it is safe to hold your Ethereum on Arbitrum according to Vitalik Buterin himself.

How does Arbitrum achieve faster and cheaper transactions? Hint: It has to do with being an optimistic rollup. At its most basic level, an optimistic rollup takes transaction data occurring on the Layer 1 and “batches” or “rolls” it all up together and processes it off-chain. Then, the data is compressed and submitted back to the Layer 1 main chain. Additionally, in the case of an optimistic rollup, it is assumed that all transactions they are processing are correct. Since the data is assumed to be correct rather than proven to be correct, optimistic rollups have a challenge period where suspected fraudulent transaction data can be spotted out and reverted. This is why bridging funds from Ethereum to Arbitrum only takes ~10 minutes but bridging funds back from Arbitrum to Ethereum can take ~1 week. Still not getting it? We highly recommend checking out this LimeChain blog post further discussing optimistic rollups. It is a tricky concept to grasp and we’re sure we didn’t do it justice by trying to explain it all in one paragraph, but we have other things to discuss!

If you’re not sold on Arbitrum yet, allow us to convince you with two simple sentences. As of writing, a typical Uniswap DEX transaction costs ~$30 in fees on Ethereum (Which is relatively cheap compared to when Ethereum is congested). For Arbitrum, on the other hand, a typical Uniswap DEX transaction only costs ~$3…

This all sounds great, Ethereum without the high fees, how do I invest!?! Well, to put it simply, you can’t… at least not directly. Arbitrum currently does not have a token associated with it. All gas fees are paid in ETH. However, many are speculating that Arbitrum will release a token at some point in the future. Personally, we believe this will eventually happen, especially when you consider the fact that team behind Arbitrum, Offchain Labs, raised $120 million at a $1.2 billion valuation back in August. The easiest way for those investors to realize the gains on their investment is *probably* through a token.

Even though there isn’t a token, this doesn’t mean we can’t try to place a valuation on Arbitrum. As of writing, Arbitrum has $2.16 billion in TVL. Although Market Cap-to-TVL comparisons are somewhat a meme, we will be using this simple comparison to give us a ballpark estimate of what Arbitrum’s hypothetical market cap could be valued at. Currently, there are 13 smart contract platforms with over $1 billion in TVL. By taking the median, 25th percentile, and 75th percentile Market Cap-to-TVL numbers of those 13 smart contract platforms, we arrive at these estimates:

Additionally, we also compared it to Metis, another Layer 2 platform for Ethereum. If Arbitrum was to launch a token tomorrow, we would expect it to launch with a market cap in the $2-$8 billion range. Based on these numbers, we can see that Arbitrum has already established itself as a valuable smart contract platform. Out of all smart contract platforms, both Layer 1s and 2s, Arbitrum already has the 10th most TVL. We feel this is only the beginning for Arbitrum as Layer 2s should continue to grow in popularity throughout 2022 and beyond.

However, since this token is purely hypothetical and doesn’t exist yet, the only way to “invest” in Arbitrum is through its fast-growing ecosystem. It is time for a journey into Arbitrum’s vast ecosystem in which we will try our best to highlight all the wonderful opportunities that it has to offer!

The Ethereum Natives

If you’re not a risk-seeker and prefer to interact with only established Ethereum DeFi protocols, then this section is for you. Perhaps the most important factor for Arbitrum’s success is if Ethereum DeFi protocols can successfully migrate to it. After all, why would you use an Ethereum scaling solution if you couldn’t actually interact with any Ethereum based protocols? Thankfully, Arbitrum was created with this specific purpose in mind. Arbitrum is highly compatible with the Ethereum Virtual Machine (EVM). If you don’t know what means, it basically just means that Arbitrum’s coding language is extremely similar to Ethereum’s. Developers familiar with EVM can just as easily build and code on Arbitrum as they do with Ethereum, making it simple for Ethereum dApps and protocols to deploy on Arbitrum.

These Ethereum native protocols have made up the bulk of TVL for Arbitrum in the early stages. Starting with SushiSwap, it is currently the biggest protocol on Arbitrum and represents a whopping 28.90% of all TVL. Perhaps most interestingly, Sushi on Arbitrum has generated favorable TVL compared to the Ethereum mainchain. $623m in capital resides on Sushi on Arbitrum while $2.6b resides on Sushi on Ethereum. The successful deployment of Sushi on Arbitrum has been a huge positive for the ecosystem. The DEX has provided the ecosystem with ample liquidity, allowing users to trade their favorite pairs with little slippage. In just the past 24 hours, Sushi’s AMM has done $74 million in trading volume. Additionally, trading pairs such as WETH-USDC, DPX-WETH, or MAGIC-WETH consistently do over $100 million in trading volume per week.

Although Sushi has inarguably been the most successful deployment of an Ethereum protocol on Arbitrum, there are plenty of other successful ones. Are you a fan of stables? Arbitrum has got you covered. Both Curve Finance and Abracadabra Money have launched. The two have ~$235m and ~$222m in TVL, respectively. All in all, many of your favorite dApps and protocols have probably already deployed on Arbitrum. Just to name a few, Uniswap, Balancer, Ren, Multichain, and Synapse have all successfully deployed. And, if you’re worried about these deployments slowing down, Yearn Finance has deployed on Arbitrum as recently as this week. As time goes on, more and more dApps and protocols will continue to launch on Arbitrum.

The Royalty of Arbitrum

Although these deployments of Ethereum native dApps and protocols on Arbitrum may represent the bulk of capital on the Layer 2, many exciting new protocols and dApps are launching natively on Arbitrum. By far, the three most successful to date are Dopex, GMX, and TreasureDAO. If you’re looking for exposure to projects that will continue to increase in valuation alongside Arbitrum’s growth, this is probably the best place to start. These three projects have fostered most of the activity on Arbitrum, so let’s give an overview of each one.

Dopex

Dopex was the first major protocol to launch natively on Arbitrum, and by this point, the two have become synonymous with one another. Built by anon TzTok-Chad and backed by famous DeFi whales such as Tetranode and DeFiGod1, Dopex has made its way into the portfolio of every DeFi degen. Dopex is a decentralized options platform, giving users the ability to trade options while maximizing liquidity and minimizing risk. Currently, its main product is Single Staking Option Vaults (SSOVS). Users can deposit assets such as ETH, DPX, rDPX CRV, BTC, BNB, etc. in to either call vaults or put vaults and collect premiums and farming rewards on them. Essentially, by depositing into these vaults you are either writing a call or put. On the flipside, users can also purchase these options.

Dopex utilizes an intuitive two-token model to best capture the value of the protocol. DPX is the governance token of Dopex. It is used to vote on any governance proposals for Dopex. Additionally, all fees generated by the Dopex platform will be distributed to DPX holders in an unreleased veTokenomics system (That’s right, veDPX). rDPX is the secondary token of Dopex and its original intention was to be a rebate token for option writers who suffered losses. However, per the rDPXv2 paper, additional value will be added to the token as it will be used to mint synthetic assets and Dopex’s own stablecoin.

If Dopex has caught your interest and you would like to learn more, I highly recommend checking out this article by Richmore Capital!

GMX

GMX is a decentralized perpetual exchange that is launched on both Arbitrum and Avalanche. Rather than going through a centralized exchange such as Binance or FTX to trade longs and shorts with leverage, GMX allows you to trade ETH, BTC, LINK, and UNI perps with up to 30x leverage on a decentralized platform. Despite its few offerings, GMX has certainly become a main player in the decentralized perpetual exchange market. To date, GMX has done over $16 billion in trading volume and has generated over $22 million in fees.

Similarly to Dopex, GMX has also implemented a two-token model. GMX is the main governance token which enables users to vote on any governance proposals. Additionally, it can be staked to receive 30% of the platform’s fees. The second token of the GMX platform is the GLP token. This token is the liquidity provider token and when staked, receives 70% of the platform’s fees. If you would like to learn more about GMX, I highly recommend checking out this article by blocmates!

One last thing we want to touch on before moving on to TreasureDAO is the interesting way in which GMX has fostered a community around its project. An NFT collection called GMX Blueberry Club was launched in December 2021 surrounding the GMX protocol. Although the set of 10,000 can be used as your profile picture on social medias, there are real financial benefits that come with it. The team behind the NFT project has amassed a treasury of over $650,000 where its proceeds can be distributed to members of the blueberry club. Personally, we think this is a great way to create community around a project and promote it. Now, users of your protocol can identify with it in an easy manner and even reap some financial benefits from it. The success of GMX Blueberry Club has even inspired other protocols such as Dopex to launch their own Dopex NFT collection. It will be interesting to see if other Arbitrum native protocols will continue to implement this NFT method of growing and promoting their communities.

GMX Blueberries

TreasureDAO

One of the hottest narratives of the past few months has been the metaverse. As such, Arbitrum wouldn’t be complete without an interesting metaverse project being built on it. Enter TreasureDAO. TreasureDAO has some ambitious plans centered around the game its building called Bridgeworld. However, Bridgeworld is not your ordinary game.

Bridgeworld aims to be the “bridge” between all different and various metaverses and NFT projects. Bridgeworld will be the link between different kinds of independently developed metaverse projects. Additionally, MAGIC, the token of TreasureDAO, will be the reserve currency of all these interlinked projects. To interact with any one of these metaverse marketplaces, MAGIC will be needed. TreasureDAO and Bridgeworld are still in their infant stages, but MAGIC trading at a market cap of over $100 million shows that there is high speculation on the potential of it. Admittedly, TreasureDAO has just recently came into our focus so we’re still learning about it as we go. To get a better understanding of TreasureDAO, we recommend checking out this article by 0x_fren!

The Newcomers

Although Dopex, GMX, and TreasureDAO may be the most successful of the Arbitrum native projects, there are many, many others with potential. Arbitrum’s blockchain has provided many developing projects and teams a perfect place to launch their projects. We won’t be able to list them all, but here are few that have caught our eyes!

TracerDAO

TracerDAO is a new and innovative platform for decentralized perpetual trading. As one member of their discord put it, the goal is to be the “Uniswap of derivatives”. TracerDAO’s key innovation is the usage of Perpetual Pools. This is important as it allows one’s long or short position to be tokenized. This brings along a variety of benefits which includes being able to borrow against this position, trading it on a secondary market, and not be at risk of being liquidated. Although the v1 perpetual pools are live, the v2 perpetual pools should be launching on Arbitrum in the next couple of weeks.

We’re super excited for this launch and will be paying close attention to it! We’ve talked to some members of the team, and they seem committed to the success of TracerDAO. TCR is the token behind the DAO, and it is a typical governance token. It is used to vote on proposals related to deploying new code, modifying existing code, and controlling the treasury funds. To learn more about TracerDAO, we recommend checking out their Documents!

Jones DAO

Jones DAO is a brand-new protocol on Arbitrum that has just completed its public sale. The goal for it was to raise 5000 ETH. It smashed this goal and raised over 23,000 ETH! Jones DAO is heavily intertwined with Dopex as the aim of Jones DAO is to be an option strategy platform. Essentially, users who don’t want to actively manage their positions can deposit their assets into Jones DAO and the protocol will do it for them, mainly through utilizing Dopex SSOV’s. Various permissionless vaults will be eventually deployed on Jones DAO for a multitude of crypto assets. Jones DAO has an ambitious road map, and you can check it out here.

The token of Jones DAO is JONES. JONES will have different use cases including governance, fee accrual, and liquidity mining. For all you veTokenomics fans out there, JONES will also be implementing veJONES in Q2 to better the efficiency of the protocol. We think Jones DAO has a lot of potential and will help make Dopex more assessable to smaller retail users who have limited experience with options!

Vesta Finance

Vesta Finance is the last of these newer protocols that we want to highlight. Vesta Finance is a protocol which mints a stablecoin called VST. Basically, users can deposit collateral tokens such as ETH, renBTC, and gOHM into Vesta Finance and they will receive VST in return. Effectively, VST is an overcollateralized stablecoin that is backed by the previously mentioned assets. The team behind Vesta Finance has plans to add more assets for collateral. Vesta Finance works under similar mechanics as MakerDAO or Abracadabra Money.

The token behind this platform is called VSTA. The benefits and uses of this token is still being discussed by the team and the community, but it is likely that Vesta will be implementing veTokenomics. It will be interesting to see if Vesta Finance can scale and provide a Arbitrum native stablecoin. If it does, it will be a great benefit to the entirety of the Arbitrum ecosystem. To learn more about Vesta Finance, check out their Documents!

Conclusion

As you can probably tell by now, the Arbitrum ecosystem is flourishing and growing. Unfortunately for us, it is growing so fast that we could not cover everything it has to offer! If you want to learn more about Arbitrum and its ecosystem, we think the best way to do it is by trying it out for yourself! Here is a tutorial by Consensys on “How To Bridge Your Assets To Arbitrum Using MetaMask” in case you’re unsure of how to do that. Additionally, the official Arbitrum bridge can be found at this link. Lastly, if you have assets on FTX or Binance, you can withdraw them directly to Arbitrum!

We hope you enjoyed this write-up on Arbitrum and its ecosystem. A lot of work, effort, and research went into this, so your support is greatly appreciated! If you wish to donate, you can donate at this Ethereum address:

0x7ba9aa5E4caD26EA5E8ba4AC286E5d38Af91F62b

All of your support really means a lot to us! If you enjoyed this article, please help us spread the word by giving it a share. If you don’t want to miss any future content we put out, make sure to subscribe! Questions, comments, or concerns? Please leave us a comment or interact with us on Twitter. We love hearing all of your feedback! Thank you once again and we hope you enjoyed!

Disclaimer: None of this should be deemed as financial advice. It is purely for entertainment purposes only. As always, do your own research.

Great Content!!!

Great read, thanks!