Altcoin Investing: Basic Tips and Advice for Identifying Winners!

Welcome to the first edition of Altcoin investing! In this edition we will identify simple tips and advice that will help you find successful altcoin projects to invest in.

Introduction

Hi all and welcome to The Average Joe’s Crypto! In this post we will be discussing several tips and strategies we use when investing in altcoins. Investing in altcoins is probably one of the more challenging things to be successful at in crypto. However, we believe there are strategies you can employ to help make successful altcoin investments!

Before we jump into these strategies, we just want to quickly define what an altcoin is. Here at The Average’s Joe Crypto, we believe that any coin that isn’t Bitcoin or Ethereum is an altcoin. This is a very broad definition, but we think it’s appropriate when you consider the history of the crypto market. Ever heard of Peercoin, Omni, or Namecoin? Yea, we didn’t think so.

If you have some free time, we recommend checking out this snapchat of the crypto market on January 26th, 2014 (LINK). 99% of those coins are basically now worthless. Also, it was before Ethereum was even released! With that out of the way, let’s get right into it!

Should you Buy Memecoins?

Allow us to start with a simple answer: No.

Moving on to the next topic… Fine, we’ll explain why. Memecoins are a very controversial subject in the crypto world. On one hand, memecoins like Dogecoin introduced a lot of people into crypto, which is undoubtedly a good thing. Additionally, if you got in on Dogecoin early, your returns are absolutely ridiculous. Seriously, the one year returns on Doge as of writing are 8,278.28%, absurd.

However, despite those absolutely ridiculous returns, we strongly do not recommend investing in any dog coins, memecoins, etc. Why? Well, put simply, they really don’t do much. On a technical basis, there isn’t anything Dogecoin did better than any other existing crypto. It made those returns off a strong community, Elon Musk shilling it, and an unreal amount of hype.

Now, will there be future spinoffs of dogecoin and other memecoins that will attract a massive amount of hype and produce great returns? Probably, but try predicting which one. Investing in these memecoins is essentially a lottery. Unless you can predict which one is going to get shilled by one of the world’s richest persons, we recommend avoiding memecoins and dog coins as there are better opportunities out there.

Dogecoin was a once in a lifetime opportunity. Don’t go chasing the next “dogecoin.” Chances are you’ll lose a lot of money this way.

What does the Coin do?

One question you should ask yourself before you buy any coin is: What does this coin do? Can’t answer that? Then you’re not ready to invest. Now, you don’t need to have an extremely in-depth answer, but if someone was to ask you what the coin does, you should be able to give a brief synopsis of exactly that.

Ok, understood. But what should I be looking for in this coin? Well, that is the tricky part, but here’s some advice that can help you. Generally speaking, you want to find coins which try to provide solutions for some sort of problem. Let’s go through an example.

One of the key aspects of crypto is decentralization. You want to have a working coin which isn’t controlled by one central entity. If someone can wake up and decide to change the features of the coin or blockchain, then it’s centralized. One section of the crypto markets that struggle with this are stable coins.

Stable coins are a key component of the crypto market. However, most of them are centralized, which goes against the ideas of cryptocurrency. The two stable coins in the top 10, USDT and USDC, are both controlled by a central authority. USDT is controlled by Tether and USDC is controlled by Coinbase and Circle. Not good.

We have identified a problem: Centralized stable coins. What’s the solution: A Decentralized stablecoin. Enter LUNA. Luna is the coin that powers the Terra Ecosystem. What’s that? Terra is a decentralized and trustless blockchain that works to create decentralized stablecoins such as UST and maintain their pegs. Here’s a diagram of how it works:

Luna is the governance & staking coin behind Terra. In simpler terms, Terra does not work without Luna. See where this is going? If decentralized stable coins will be increasing in demand, then you should invest in the crypto which enables that. Problem. Solution. Investment.

Has Luna been a good investment? Let’s check the one year returns: 11,266.7%. Definitely.

Now obviously, Luna is just one example of this Problem-Solution framework. There are countless problems in the crypto space with even more countless solutions. It would be impossible to identify all of these, so that’s why we just want to give you the general framework we use to first identify possible altcoin investments.

What’s the Tokenomics?

This is one of the most important factors when investing in altcoins. An altcoin might seem like a great investment at first, but then you look at the tokenomics, and YUCK! You might be asking yourself right now: What’s tokenomics? Allow us to explain.

Tokenomics is a mesh of two words: Token & Economics. It deals with how tokens are created, introduced into the blockchain, managed, and in some cases, destroyed. As one could imagine, tokenomics is the study of the token economics of a cryptocurrency. Let’s go over some basics:

Allocation: Allocation is the first aspect you should consider when evaluating the tokenomics. Essentially, allocation is how the coins were distributed at the very beginning of the project. Increasingly rare, but best for investors, is a crypto that implements a Fair Launch. This entails that when a crypto launches, no one has special access or rights. Everyone plays by the same rules to acquire the coin, so therefore it is “fair.” Although not an altcoin, an example of a fair launch is Bitcoin. Once Satoshi Nakamoto published the Bitcoin code and software, anyone who chose to could’ve mined Bitcoin. No individual had special rights when it came mining/acquiring new Bitcoin.

However, the majority of altcoins will not have fair launches. This isn’t a negative per say, but it requires attention. At launch, coins may be reserved for developers, early investors, venture capital funds, etc. Here is the allocation diagram of a popular altcoin, CVX:

See how some CVX is reserved for Investors and the Team? However, CVX is actually an example of good allocation. 75% of all CVX (Liquidity Mining + Curve LP Rewards) can be acquired by anyone who wishes to partake in the project. There is no exact number you should be looking for, but you generally want to see the majority of allocation be for retail investors and not reserved for “special” investors or the developers.

Distribution: This is very similar to allocation, but has to do with how tokens will be distributed throughout the life of the project. The CVX pie chart showed earlier is also relevant to this section. Currently, there are two ways in which coins are distributed throughout the project.

The first is Proof-of-Work (PoW). In simple terms, PoW is when new coins are introduced into the market through “miners”. When miners validate and confirm a block on the blockchain, they are rewarded with new coins. How miners confirm blocks is extremely hard to understand and would require it’s own separate post to explain. For now, just associate PoW as miners validating transactions on the blockchain and being rewarded in new coins for their efforts.

The second is Proof-of-Stake (PoS). PoS is does not require miners and is much less energy intensive. In PoS, users lock up already existing coins through staking and validate transactions that way. As a reward for locking up their coins and helping the blockchain keep moving, those who stake their coins are rewarded with new coins.

Now whether is be PoW or PoS, the important part you want to look at if the crypto is inflationary or deflationary. Inflationary means new coins are being introduced to the blockchain, and deflationary means old coins are being removed from the blockchain and destroyed. Most projects will be inflationary at first, but could change to deflationary later on. As a rule of thumb, you want to avoid projects with high inflation as this will devalue already existing coins.

Now there is more to tokenomics then just allocation and distribution, but those are the two most important factors for tokenomics you should consider. We’ll cover more tokenomics in future editions!

What else do you Look for?

Here is just a collection of other metrics you need to take a look at it before you invest. These aren’t the only ones we would recommend, but at a bare minimum you need to research these.

Price: This one is the easiest. It’s simply the $ amount you have to pay to receive one coin of the specific crypto you are looking at.

Circulating Supply: Another fairly easy concept. It’s just all the coins of a specific crypto that are already in existence.

Total Supply: This is slightly different from Circulating supply. It’s the amount of coins that will be in circulation once all coins have been mined or released by some other process. For example, take Chainlink. It has a circulating supply of 452 million LINK. There are currently 452 million LINK in existence. However, it’s total supply is 1 billion LINK. That means there is still 548 million LINK yet to be released on the market.

Market Cap (MC): This is an important one. It measures how much money the entire crypto is worth. To find this, you take price and multiply it by the circulating supply. This is important indicator for the growth potential of a coin. Take Dogecoin for example. DOGE is currently trading at roughly $0.24. Based on just price, a move to $1 doesn’t seem all that impossible. However, when we look at market cap, we can see that a price increase to $1.00 would increase Doge’s market cap by ~$100 billion. That’s a lot of money. So yes, Doge going to $1 is extremely unlikely.

Fully Distributed Value (FDV): Similar to market cap and just as important. It measures how much the entire crypto would be worth if all future coins were already in existence. To find this, you take price and multiple it by the total supply. If a coin has a low market cap, but an extremely high fully distributed value, that should be a red flag.

Trading Volume: Another important yet simple statistic. It is $ amount of the crypto that is traded every day. Obviously not all altcoins will have high trading volumes (especially if they are microcaps), but a low volume could be indicative of a dead or dying project. The higher the volume, the better.

Those are some of the most basic metrics you should be looking at every coin before you invest in it. These next three are specifically for DeFi coins. Don’t know what DeFi is? Check out this quick Coinbase Basics explainer (LINK). We will have a future post where we dive deep into DeFi, but for now that website will cover the basics.

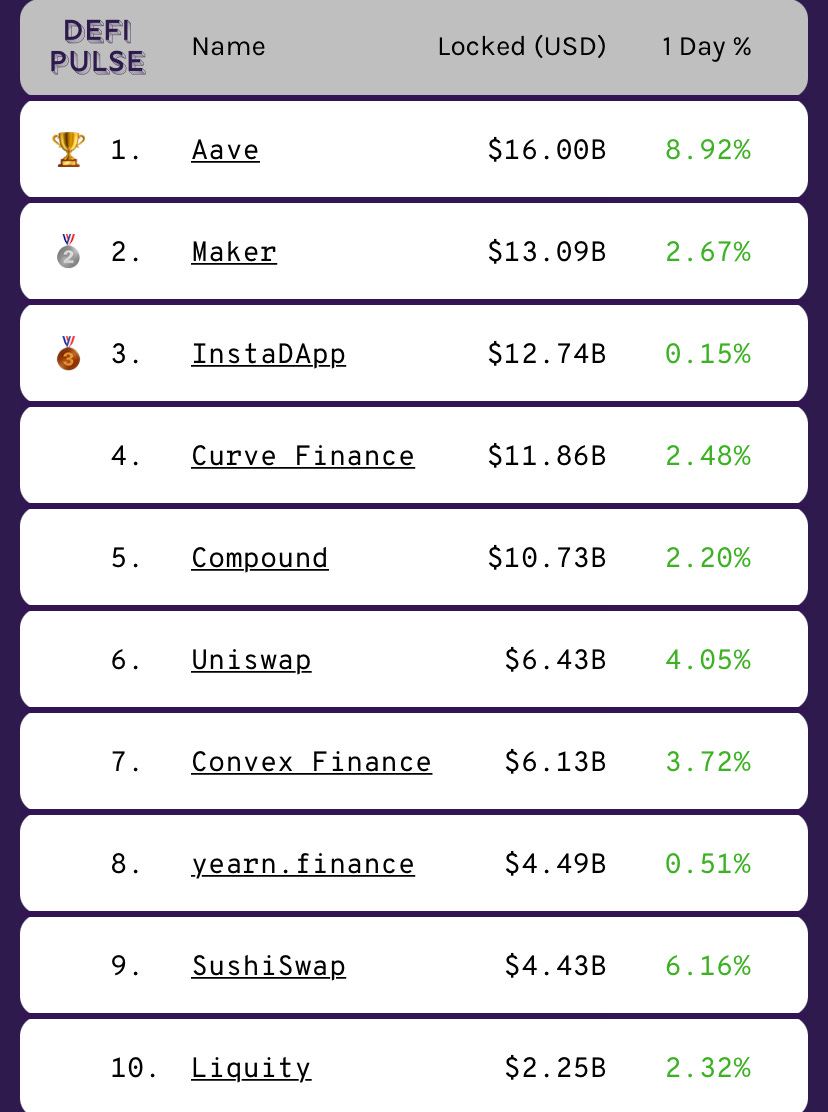

Total Value Locked (TVL): This is probably the hardest of these metrics to understand. To interact with some DeFi protocols, you need to ‘lock up’ some assets in the protocol. This isn’t a one-to-one comparison, but it’s the same concept of depositing money in a bank. Total Value Locked just measures the $ amount of assets that are staked in the DeFi protocol. Still not getting it? If not, check out this website. Additionally, here’s a list of the top 10 projects in terms of TVL:

Market Cap/Total Value Locked (MC/TVL): This is a great way to measure DeFi coins. It’s simply just the market cap divided by the total value locked. What this shows you is relatively overvalued or undervalued a DeFi protocol is. The lower the ratio, the better. The higher the ratio, the worse, If a protocol has a low market cap but a high total value locked, that could be a sign that it is undervalued.

Fully Distributed Value/Total Value Locked (FDV/TVL): The same idea as MC/TVL, you just replace market cap with fully distributed value. If a project doesn’t have many coins in circulation, FDV/TVL would be a better predictor of valuation than MC/TVL.

Exchanges: This one isn’t necessarily a metric, but rather what exchanges is the coin listed on. The more the better! A lot of altcoins won’t be listed on major exchanges such as Coinbase. So where do you get them? Generally, any crypto that is built on the Ethereum network (ERC-20 Token) will be available on Uniswap. Additionally, a good exchange that doesn’t require KYC is KuCoin. KuCoin has tons of undervalued altcoins, just know that it isn’t a US based exchange. If you want to download KuCoin, here is the Apple App Store Link.

Those are just some of the metrics you need to know before investing in an altcoin. This isn’t a one-size-fits-all approach, but generally you want to identify altcoins with low market cap, similar fully distributed value (compared to market cap), high trading volume, and low total value locked ratios.

How do you Minimize Loss?

You wake up and go check the crypto charts. BOOM! The coin you’ve been researching is up 100% in the past 4 hours. Fearing you’re gonna miss out, you smash the buy button and use your last remaining dollars in your portfolio to buy this coin.

By the next day, the coin is down 50% and back to where it was before the pump. Devastated, you sell what you have of the coin to prevent further losses.

You ever been in that situation? Maybe, maybe not, but it teaches a valuable lesson. Don’t chase the pump. The biggest key to altcoin investing is not necessarily how to get crazy gains, but how to prevent losses and maintain your capital. Here’s two things we recommend to do that.

Don’t chase the pump. As we said earlier, this is a valuable lesson. Often times when you see an altcoin pop off for gains of 50%, 100%, 200%, etc. in just one day, it’s already too late. The best thing to do is wait on the sidelines and wait for the next opportunity. We know this is difficult, but you cannot be an emotional investor, you have to be a rational investor. Also, this doesn’t mean you can’t invest in the coin at all, this just means to wait for the price to stabilize. After a big pump, usually a correction follows. That’s when you buy.

Don’t go all in. We can’t stress this enough. Even if you think you’ve found the greatest altcoin investment ever, do not go all in. Even seemingly the best altcoins will fail. That’s just the way this market works. Personally, we recommend a max of 5% of your portfolio net worth when you first invest in an altcoin. Generally, however, we limit each of our altcoin investments to 1%-3% of our portfolio.

Why do this? Well, you only really need to hit on a couple of your altcoin investments. It is not uncommon for altcoins to 5x, 10x, or even 100x their value. If just one of your altcoin investments goes up 10x, it will make up for the 10 other altcoin investments that didn’t.

Conclusion & Our Twitter

Hopefully the next time you’re looking to make an altcoin investment you’ll consider some of the things we wrote in here. These aren’t the only factors you should include when you’re making investment decisions, but it’s a good start. Avoid memecoins, identify projects that provide solutions, research the tokenomics, check the metrics, and then invest. Don’t put all your eggs in one basket, diversification is key for altcoins. Also, DO YOUR OWN RESEARCH!!!

Also, please don’t forget to follow us on Twitter! We would love to interact with you guys and answer any questions you might have. Our goal is to help you! In the future, we plan on listening directly to our Twitter followers to see what types of posts they want next.

Well, that’s all we have planned for today. We hope you enjoyed this post on altcoin investing. Questions? Don’t be afraid to ask! Any feedback is greatly appreciated. Have a wonderful day!

Disclaimer: None of this should be deemed financial advice, it is purely for entertainment purposes only.