Hi all, and welcome back to Average Joe’s Crypto! Wow, it’s been a long time since I said that… I’m sorry for the lack of posts in the second half of 2022, but I can assure you that I have not gone anywhere. Since I have a full-time job in crypto, I find myself not having the time to produce independent content. Nevertheless, I wanted to share 10 ideas/themes/predictions related to crypto markets in 2023.

I did something similar last year, which you can find here. Last year’s predictions were questionable at best, so with another year of experience under my belt, hopefully these predictions will pan out better than last year’s. Additionally, I’ll try to keep these predictions as succinct as possible, so I may recommend some additional readings as well.

Before getting started, here’s a friendly reminder to subscribe to this substack for more crypto-related content!

Without further ado, here are my 10 crypto predictions for 2023!

10) Bitcoin Bounces Back

Confidence Level: Low

As brutal as 2022 was for crypto as a whole, 2022 was exceptionally rough on the Bitcoin community. 2022 was the year of death for all Bitcoin-related narratives. Let’s take a quick look:

Bitcoin is an inflation hedge: Down ~70% in the highest inflationary period in all of Bitcoin’s existence.

Nation states will adopt the Bitcoin standard: Nope, just El Salvador and the Central African Republic.

Corporations will add Bitcoin to the balance sheet: Tesla sold ~75% of Bitcoin holdings.

Lightning Network will accelerate Bitcoin adoption: Lightning Network is the 62nd largest protocol by TVL.

Taproot will accelerate Bitcoin adoption: ???

Compare this to something like Ethereum which, despite having an equally rough price performance, had some positive narratives in 2022 such as the successful completion of the merge and arguably the best monetary policy of any blockchain. Going into 2023, it seems like Bitcoin has no positive catalysts for it…

However, Bitcoin seems to perform best when its doubters are at their loudest. I expect 2023 to be nowhere nearly as bad as 2022 for Bitcoin. What exactly does this mean? For starters, I think 2023’s low will not go lower than 2022’s low of ~$15,700. At the same time, I don’t expect we hit 2022’s high of ~$47,800.

No, I don’t have any “technical analysis” to back this up, but FTX’s blowup seems to have been the last forced large seller of BTC that could drive us down lower. A large question mark looms over DCG/Genesis, but that situation seems to be resolvable without any FTX-style drama. For an analysis of the DCG/Genesis situation, look no further than Messari’s Crypto Theses 2023.

At the same time, I don’t foresee any large positive price catalysts for Bitcoin. But the lower the price of Bitcoin, the more attractive it is for large entities, funds, corporations, etc. to buy some. I still think that nationwide adoption of the Bitcoin standard does occur, but that narrative will most likely resume after 2023.

9) Web3 Gaming Growing Pains

Confidence Level: Low

Are there any fun Web3 games yet? No? Didn’t think so…

Despite roughly ~$18 billion being poured into the Web3 gaming sector over the past 2 years, the sector has yet to produce an AAA-level game that people actually want to play. The popular “Play-to-Earn” model blew up spectacularly in 2022, and Web3 gaming doesn’t seem to offer anything exciting other than NFTs. I have a gut feeling that this doesn’t change in 2023.

The biggest issue for me is that Web3 gaming is too focused on being a blockchain-based game, rather than just being a fun game. Add that on to the complexities of using a blockchain for anyone that isn’t a crypto native, and you got yourself an issue:

Boring games + Complex to access & play = Poor adoption

Although I am somewhat pessimistic on Web3 gaming for 2023, I do think Web3 gaming will eventually become a success. However, I think this occurs once UI improves and blockchains become more “friendly” for the average user. In fact, I’d wager that most people that end up playing the first Web3 based blockbuster game will not even realize they’re using a blockchain.

This doesn’t seem likely for 2023, and as such, I expect some growing pains for Web3 gaming when compared to the rest of the crypto industry.

8) GMX Slows Down

Confidence Level: Low

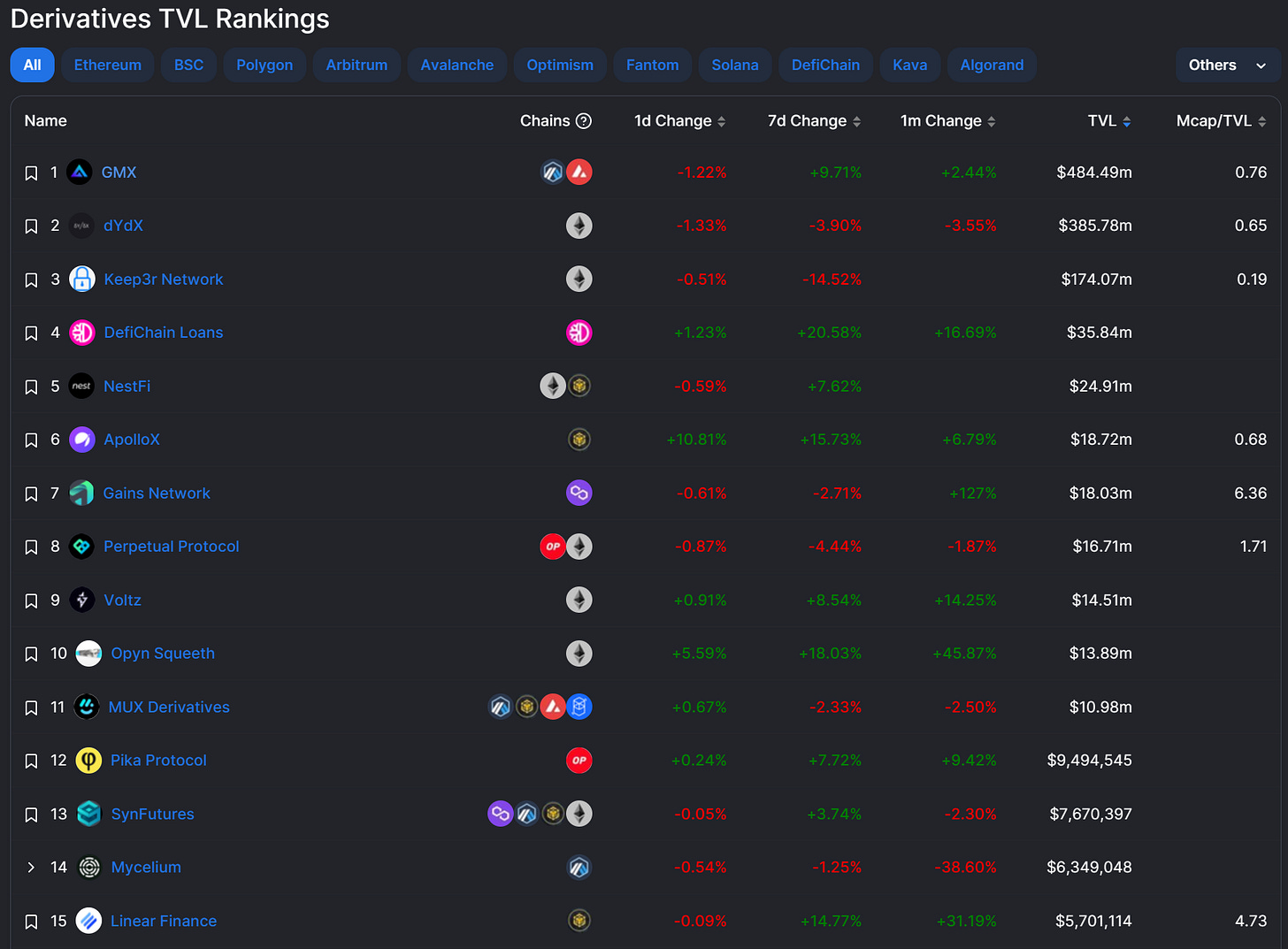

Perhaps the biggest winner of 2022 was GMX. The perpetual exchange grew substantially this past year, with trading volumes increasing by over 800% and daily active users increasing by over 1,800%. Further illustrating just how dominant GMX has been, it’s TVL represents ~38% of Arbitrum’s TVL.

While I don’t expect GMX to necessarily be a failure in 2023, I do expect its growth and market share to slow down and possibly even decrease. There are some issues regarding GMX’s economic model, as outlined in DeFi Education’s Deep Dive on GMX.

Additionally, competition has been heating up in the derivatives sector. Gains Network recently launched on Arbitrum, and offers substantially more assets to speculate on. Also, DYDX is slated to launch as its own appchain in Q1 of 2023, which could further drive market share away from GMX.

GMX is one of the few protocols to actually have PMF, and other teams are quickly noticing. If GMX doesn’t continue to innovate, it could see stagnated growth in 2023. I don’t think GMX will lose the #1 spot for decentralized derivatives, but I do think it will see reduced market share in 2023 as other protocols gain traction.

7) APE Goes Top 10

Confidence Level: Medium

I know, I know. Doesn’t this conflict with Prediction #9? Well, not quite… Allow me to explain:

NFTs =/= Web3 Gaming

Although I am generally bearish Web3 Gaming for 2023, NFTs is one of the areas where I’m quite bullish on, especially the ApeCoin ecosystem. Similar to how some blue-chip projects emerged out of the ICO boom of 2017 (Synthetix, Aave, Chainlink, etc.), some blue-chip NFT projects will emerge out of the NFT boom of 2021. The most obvious pick to lead the pack are the Bored Apes (BAYC). BAYC already has the largest market cap of all NFT projects, and I expect this to continue throughout the new year.

While this is not exactly a bold prediction, I do think BAYC’s continued success will eventually catapult APE into the top ten cryptocurrencies by market cap. There are two things crypto retail investors love more than anything else:

Memecoins

NFTs

Luckily for APE, it exhibits both of those qualities. If retail returns in 2023, I think APE could be one of the top picks for retail investors. If BAYC sees continued dominance, priced-out retail investors will want exposure to the “hype” and buy APE instead.

Lastly, I do also have to mention that ApeCoin does actually have one of the most impressive communities out there. Their DAO actually does DAO stuff, which not many protocols can say as of late. APE has all the makings of a retail favorite, and I do expect it to eventually go on a run.

6) Fantom Outperforms

Confidence Level: Medium

ETH maxis may have you believe differently, but it seems like multi-chain is here to stay. I wouldn’t say alternative smart contract platforms have a repeat of the 2021-2022 bull run, but I do expect alternative smart contract platforms to slightly outperform the rest of the crypto market.

If you also agree with the above, I suggest you look no further than Fantom for your pick of best performing alternative smart contract platform this year.

Even though I’ve been burnt by Fantom in the past (Thanks Solidly!), I find myself once again back on the chain. And apparently many of you do as well. According to Nansen, there have been 18.5 million active addresses on Fantom within the past 30 days. For comparison, BNB Smart Chain (the most active chain by addresses) had 19.4 million active addresses over the same period. Interesting…

Other than users returning to Fantom, it has some other positive catalysts. For starters, Fantom has a war chest of over $250 million dollars, not including FTM holdings. That is no number to slouch at and practically guarantees that Fantom will have the firepower to compete with other smart contract platforms for the foreseeable future.

Speaking of other smart contract platforms, Fantom is the 20th largest smart contract platform by market cap. Some notable smart contract platforms in front of it include Luna Classic, EOS, and Internet Computer. Not exactly the cream of the crop right there… By the end of the year, I wouldn’t be shocked if Fantom was a top 10 smart contract platform by market cap.

Perhaps most importantly, Fantom’s Gas Monetization program could entice may protocols and developers to build on Fantom. Fantom understands that, unless your Ethereum, dApps drive blockchain usage. Fantom may just be one or two killer dApps away from becoming the top alternative EVM-compatible layer-1 chain. Its Gas Monetization program could achieve that.

5) USA Crypto Regulation Remains in Limbo

Confidence Level: Medium

Another year, another failed attempt by the US government to pass meaningful crypto regulation. I don’t know if you remember, but prior to the collapse of FTX, the talk of the crypto industry was the disastrous Digital Commodities Consumer Protection Act (DCCPA), spearheaded by none other than SBF. The bill would have essentially killed DeFi, or at the very least made it practically impossible for Americans to participate in the budding industry. Thankfully, FTX’s association with this bill has more or less made it dead on arrival.

So, where does the US government go from here regarding crypto? Well, just like years past, probably nowhere. Without getting political, it’s obvious to see that the US government, specifically the House of Representatives, is in a delicate position. It took Speaker Kevin McCarthy 15 tries to finally win the speaker position, the most in the post-Civil War era. McCarthy had to make some serious concessions in order to secure the speaker position, which included lowering the “motion to vacate the chair” threshold from five to one.

Simply put, the House Republicans have a fragile majority. Combine this with a Democrat White House and Democrat Senate, you have the perfect recipe for a lame duck government. This does not bode well (Or maybe it does, depending on how you look at it) for meaningful crypto regulation in 2023.

However, crypto is one of those few issues in Washington that isn’t polarized by party lines. It has ardent supporters and detractors on both sides of the aisle. If a proposed crypto bill comes in either too supportive or too destructive, I have a gut feeling that one of the aforementioned groups will use government’s delicate balance to halt the bill’s progress.

As such, don’t expect too much regarding crypto regulation from the elected members of government. If any regulation comes out of this year, it will most likely come from a regulatory agency such as the SEC of CFTC.

4) The Best Liquid Staking Play is… COIN

Confidence Level: Medium

One of crypto’s first actual use-cases was that it was a pretty good method of paying for drugs online. In 2023, the crypto industry has come full circle, and everyone is talking about LSD again. Wait, we’re not talking about the drug?

Liquid Staking Derivatives (LSDs) are the hot narrative so far in 2023. Ethereum’s upcoming Shanghai Upgrade, which will enable withdrawals for staked ETH, has the whole industry bullish on the LSD sector. Popular LSD tokens have been the top performers over the past 30 days: Lido’s LDO token is up ~187%, Rocket Pool’s RPL token is up ~96%, and Frax’s FXS token is up ~124%. Everyone and their mother wants exposure to LSDs, and I’m here to tell you perhaps there is a better option than the popular LSD tokens.

That’s right, I’m talking about Coinbase’s stock, COIN. COIN took a beating the past year, for two main reasons:

The company was burning cash like a drunken sailor, and

its revenue sources were unsustainable.

The first reason is certainly still a risk, but I would argue that this risk has been largely priced in (See Coinbase bond ratings!).

As for the second reason, this is why COIN can perhaps be an interesting play. It is common knowledge by now that Coinbase revenues are cyclical with crypto cycles:

Retail here = Revenues up | Retail gone = Revenues down

It’s been as simple as that for COIN, so obviously one of the company’s large areas of focus this bear market should be to find additional sources of revenue that are not as cyclical as customer trading fees. Liquid staking might just be the solution to their problems.

Let’s take a look at staking revenues since September 2022:

Since September, Ethereum staking revenues are ~$333 million. If we annualize that, the yearly revenue for Ethereum staking is ~$800 million. Considering this was coincided with arguably the worst period for the crypto industry, I think it would be safe to say that this is arguably the floor for staking revenues.

Coinbase is currently the second largest depositor of staked ETH with a market share of ~12.7%. If all things remain stagnant, with Coinbase’s staking fee of 25%, Ethereum staking represents an additional $25.4 million of revenue per year for Coinbase. This number is small but will grow as Ethereum staking revenue grows and Coinbase increases it market share.

Coinbase is a perfect candidate to grow its market share when you consider who the marginal Ethereum staker is. At this point, every crypto native that wants to stake ETH has probably already staked ETH (Most likely with Lido) There is definitely a couple holdouts among this group who are waiting for Shanghai, but you get the point. Crypto natives are most likely already staking ETH and most likely staked with a more “crypto-native” solution such as Lido.

Post Shanghai, the marginal staker is going to be non-native crypto users, companies, funds, etc. They’re going to see a juicy advertised APR for staking ETH (~7.4% as of writing) and want exposure to that. What do you think is more likely to happen:

Some TradFi fund is going to tell their analyst to download MetaMask and stake with Lido or Rocket Pool, or

The TradFi fund will call up their contact at Coinbase and tell them they want to stake a couple $ worth of ETH.

Yeah, I know my answer too.

3) DeFi Redemption Arc

Confidence Level: High

For better or for worse, I will always remain eternally bullish on DeFi. Although DeFi has practically been in a bear market since 2020, there will come a time when DeFi makes it return to the forefront.

2023 seems like a good year to start this redemption arc.

Market cap isn’t necessarily the best indicator for DeFi strength (Plethora of valueless governance tokens due to SEC watching over like a hawk), so instead, let’s use TVL as a proxy for DeFi strength. At the start of 2022, the total TVL for DeFi across all chains was ~$167 billion. Since then, its fallen ~72% to ~$46.5 billion. Ouch… Unfortunately for DeFi, this wasn’t just a result of falling token prices, but also because of money leaving the space.

However, I’m here to tell you that this narrative of “money leaving the space” is way overblown.

Current USDT Market Cap: ~$67 billion. First time USDT hit ~$67 billion market cap: September 5, 2021.

Current USDC Market Cap: ~$44 billion. First time USDC hit ~$44 billion market cap: January 11, 2022.

Current BUSD Market Cap: ~$15.5 billion. First time BUSD hit ~$15.5 billion market cap: February 1, 2022.

And it’s not like stablecoin market cap has been dropping off a cliff as of late. In fact, the stablecoin market cap has remained largely stagnant since the Terra/3AC collapse in May and June.

The money that pumped the market to new highs during 2021/2022 is, perhaps surprisingly, still largely within the crypto ecosystem. Now, if DeFi could just provide some attractive opportunities…

People tend to forget DeFi is still only in its infant stages. While crypto has been around for over a decade, I would argue that DeFi didn’t really emerge until 2018/2019. DeFi has only been around for five years and its growth potentials, I would argue, are limitless.

For 2023 specifically, I’m looking forward to the introduction of Real-World Assets (RWAs) to DeFi. TradFi rates have been yielding more than DeFi rates since the beginning of 2022, and the introduction of RWAs on-chain could help alleviate that. Ondo Finance and Flux Finance are a set of protocols to keep an eye out on for RWAs. If DeFi could reasonably implement US treasury yields on-chain, that would be a great place to park all these sidelined stablecoins...

Lastly, in the wake of CeFi’s destruction in 2022, the case has never been clearer for transparent, on-chain DeFi. While the CeFi lenders and custodians blew up, decentralized applications such as Aave and MakerDAO kept chugging along. If 2022 proved anything, it proved that DeFi can work.

2) NFTFi Emerges

Confidence Level: High

The parallels between the ICO boom of 2017/2018 and the NFT boom of 2021/2022 are striking. In both cases, retail aped in to shiny, new objects that had no real utility and collectively got burned. However, the few that stuck around after the ICO bust and practiced proper risk management (They didn’t go 100x long/short on every 1-minute candle) eventually made it back and some in the bull market of 2020/2021. Additionally, these “useless” coins they bought in 2018/2019 now had some actual utilities as the crypto ecosystem matured.

The NFT ecosystem will largely follow the same playbook.

For NFTs, it’s 2020. Retail has been wiped out, but yet a sizeable NFT community remains. I suspect that NFT valuations will slowly rise in the beginning of this year, and the NFT community will want to use their assets in some other way besides changing their Twitter profile picture. Enter NFTFi.

At the end of the day, NFTs are a financial asset with a value. Is that value subjective? Sure, but that’s not the point. As long as someone is willing to buy, financial instruments and products will be constructed centered around these NFTs. And NFTFi has great PMF.

If I want exposure to BTC, I can just simply go out and buy some. Whether its 1 BTC, 0.1 BTC, or 0.0000000001 BTC, it’s still BTC. However, the same cannot be said for NFTs. If I want exposure to BAYCs, I have to pony up the ~$100K or I’m SOL (Not the cryptocurrency). 99.9% of market participants will not be spending $100K on an NFT. This is where NFTFi comes in.

At the end of the day, people are not buying NFTs for the “art,” they’re buying it to make money. NFTFi can provide a way for priced-out NFT investors to join in on the “money-making” fun. Projects like nftperp and 0xdx are already working on solutions for these issues and should launch in 2023.

Although NFTFi’s biggest use case is servicing priced-out investors and speculators, there are other important areas as well. The few that do own valuable NFTs will want to use their newfound wealth without liquidating their precious JPEGs. Projects like JPEG’d or Sudoswap will help facilitate the financialization of NFTs and the emergence of NFTFi.

1) Arbitrum is the Big Winner of 2023

Confidence Level: High

If you’re familiar with my account, this prediction should come as no surprise to you. I’ve been banging the drums on Arbitrum for quite some time now.

When I first wrote that Deep Dive, the Arbitrum ecosystem was just starting out. Now The Arbitrum ecosystem is flourishing. 2022 was a great year for Arbitrum, and I expect 2023 to be even better. It seems like a new Arbitrum protocol is launching every single week. And I’m not just talking about forks of other DeFi protocols, but innovative DeFi protocols with new products and features such as Y2K Finance or Gammaswap. To date, over 1.2 million smart contracts have been deployed on Arbitrum.

Layer 2s are an essential piece of the Ethereum scaling roadmap, and I fully expect L2s to become the main hubs of interaction within the crypto ecosystem. Ethereum is already the most decentralized and secure smart contract platform, with its drawback being scalability. Over the coming years, the development of L2s will help alleviate this issue. Arbitrum is pretty much the premier L2 by every usability metric, and, therefore, stands to benefit the most from the capital inflows from Ethereum and other alt L1s to L2s.

However, I would argue that L2s should benefit as a whole, and there will be no losers in the L2 wars. Other L2s like Optimism being successful is bullish for Arbitrum, and vice versa.

I could go on and on forever about Arbitrum, but instead, I’ll let someone else do the talking:

Conclusion

I hope you enjoyed my 10 crypto predictions for 2023! I look forward to your feedback, so please feel free to let me know what you agree or disagree with.

A lot of work, research, and effort went into the making of this. If you found it helpful and would like to donate, you can do so at:

0x7ba9aa5E4caD26EA5E8ba4AC286E5d38Af91F62b

All the content I put out is free, so your donations are greatly appreciated!

Thank you again for taking the time out of your day to give this post a read. Your support really means so much to me! If you enjoyed this post, please help me spread it around by giving it a share! If you want more content like this, why not subscribe? You won’t regret it! If you have comments, questions, or concerns, please feel free to either comment them or hit me up on Twitter. Once again, thank you and I hope you enjoyed!

Disclaimer: I am not a financial advisor. This website's content is for entertainment, informational and/or educational purposes, whereby, we express our own personal opinion. Nothing contained herein constitutes a solicitation, endorsement or offer to buy/sell any financial instruments, crypto-currencies and/or securities. In order to make the best financial decision that suits your own needs, you should conduct your own due diligence & pertinent research. Keep in mind, all investments involve a likelihood of risk & there is no guarantee that you will be successful in your investment.

Great work!